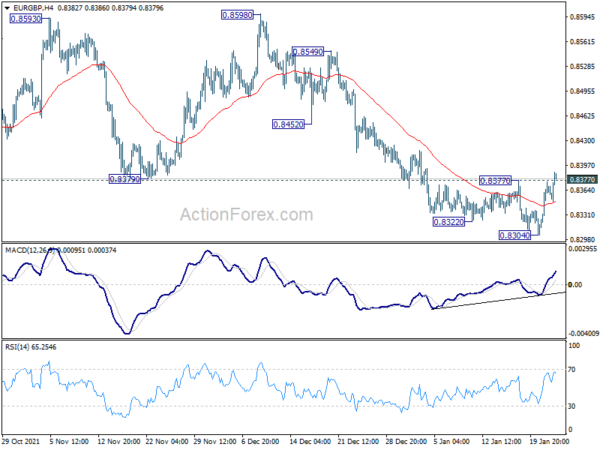

Daily Pivots: (S1) 0.8332; (P) 0.8354; (R1) 0.8393; More…

EUR/GBP’s break of 0.8377 resistance indicates short term bottoming at 0.8304, on bullish convergence condition in 4 hour MACD, ahead of 0.8276 low. Intraday bias is back on the upside for 55 day EMA (now at 0.8422). Sustained break there will pave the way back to 0.8598 key structural resistance next. For now, risk will be mildly on the upside as long as 0.8304 support holds, in case of retreat.

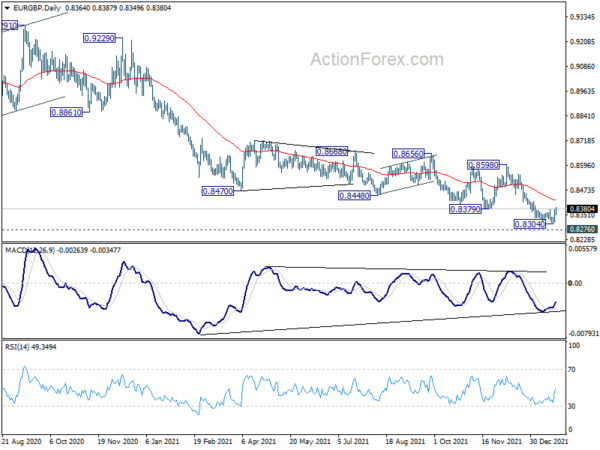

In the bigger picture, price actions from 0.9499 (2020 high) are still seen as developing into a corrective pattern. Deeper fall could be seen as long as 0.8598 resistance holds, towards long term support at 0.8276. We’d look for bottoming signal around there to bring reversal. Meanwhile, firm break of 0.8598 will now be an early sign of medium term bottoming and bring stronger rebound. However, sustained break of 0.8276 will argue that the long term trend has reversed.