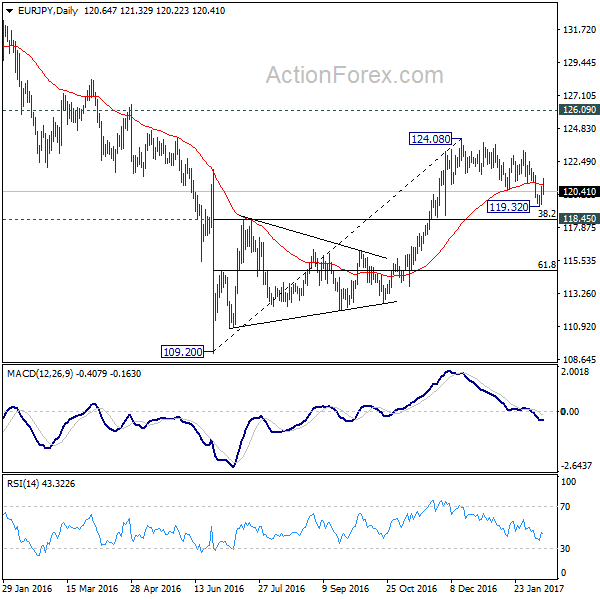

EUR/JPY dipped sharply to 119.32 last week but recovered since then. However, the recovery was weak and limited 121.32. Initial bias is turned neutral this week first. No change in the view that choppy price actions from 124.08 is a corrective pattern. In case of another fall, downside should be contained by 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39) and bring rebound. Above 121.32 will turn bias to the upside or 123.30 resistance. Break of 123.30 will likely extend the whole medium term rise from 109.20 through 124.08 high.

In the bigger picture, price actions from 109.20 medium term bottom are seen as part of a medium term corrective pattern from 149.76. There is prospect of another rise towards 126.09 key resistance level before completion. But even in that case, we’d expect strong resistance between 126.09 and 141.04 to limit upside, at least on first attempt. Nonetheless, decisive break of 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39) will argue that rise from 109.20 is completed and turn outlook bearish for 61.8% retracement at 114.88 and below.

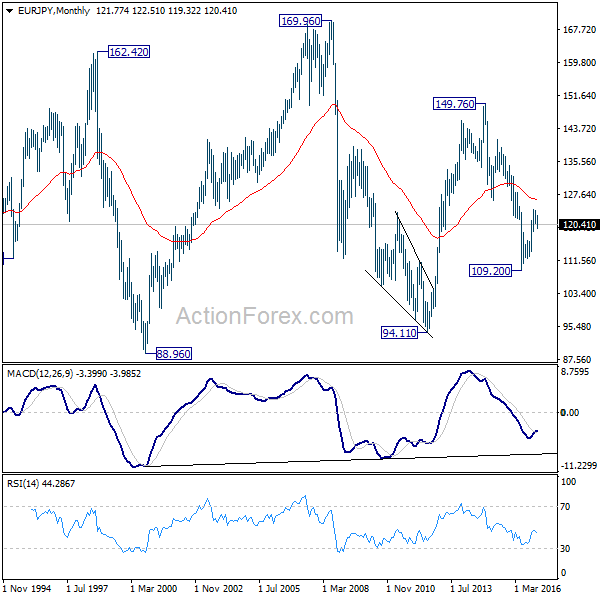

In the long term picture, current medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. Decisive break of 126.09 will indicate that such decline is completed and EUR/JPY has started another medium term rally already.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box