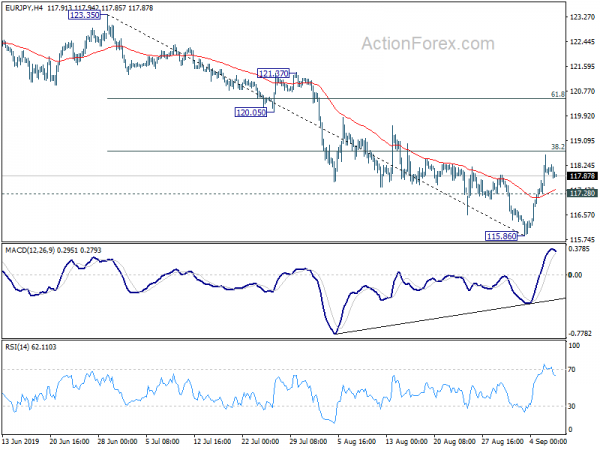

EUR/JPY edged lower to 115.86 last week but recovered strongly since then. A short term bottom should be formed on bullish convergence condition in 4 hour MACD. Further rise is expected this week as long as 117.28 minor support holds. Break of 38.2% retracement of 123.35 to 115.86 at 118.72 will pave the way to 61.8% retracement at 120.48. On the downside, break of 11.7.28 minor support will turn bias back to the downside for retesting 115.86 instead.

In the bigger picture, down trend from 137.49 (2018 high) is still in progress. It’s seen as a falling leg of multi-year sideway pattern. Deeper fall could be seen to 109.48 (2016 low and below). On the upside, break of 120.78 support turned resistance is needed to be the first sign medium term reversal. Otherwise, outlook will remain bearish in case of strong rebound.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. Break of 118.62 should now extend this falling leg through 109.48 (2016 low). With EUR/JPY staying below 55 month EMA, this is the preferred case.