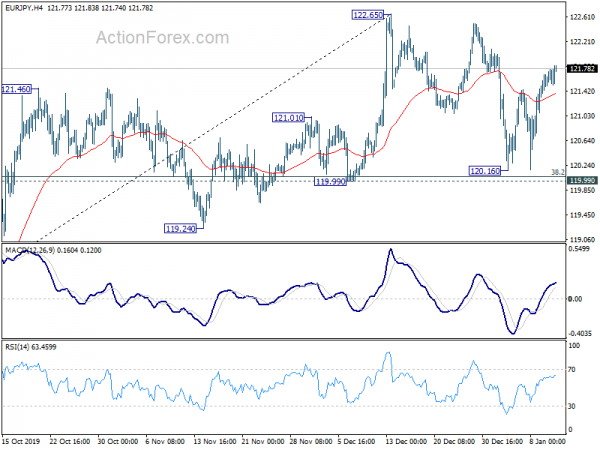

EUR/JPY’s strong rebound last week suggests that price actions from 122.65 are merely a corrective pattern. Rise from 115.86 is in favor to extend higher. Initial bias remains neutral this week first. Break of 122.65 resistance will confirm this bullish case and target medium term channel resistance (now at 124.26). However, break of 119.99 cluster support (38.2% retracement of 115.86 to 122.65 at 120.05) will argue that rise from 115.86 has completed. Deeper fall would be seen to 61.8% retracement at 118.45.

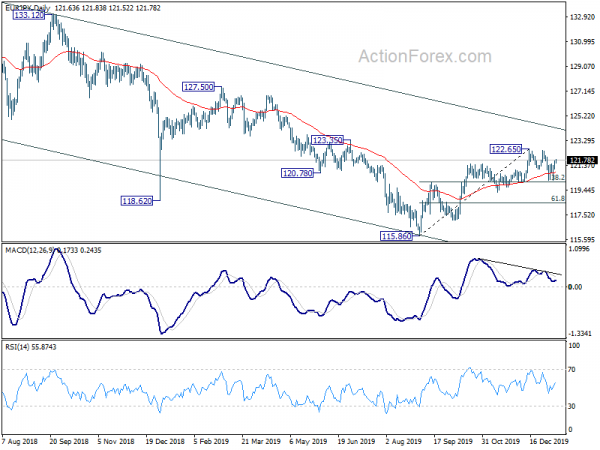

In the bigger picture, EUR/JPY is still staying in the falling channel established since 137.49 (2018 high). Rise from 115.86 is seen as a corrective rise for the moment. Strong resistance could be seen at falling channel resistance to limit upside. However, sustained break of the channel resistance will carry larger bullish implication and target 127.50 key resistance next.

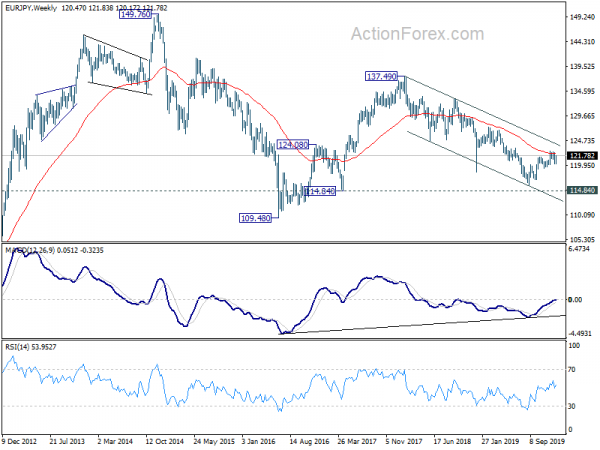

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. This falling leg would target 109.48 (2016 low). With EUR/JPY staying below 55 month EMA (now at 125.60), this is the preferred case.