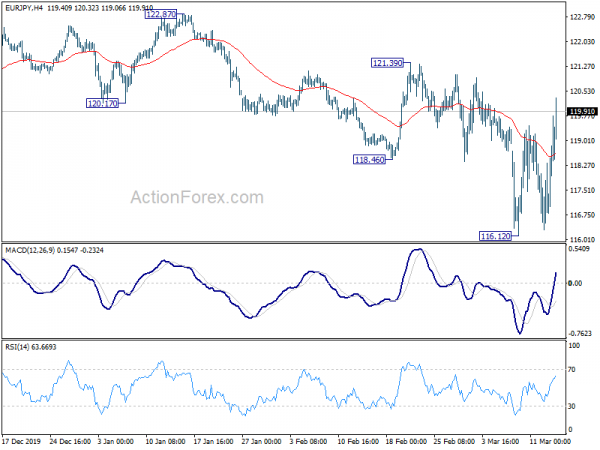

EUR/JPY staged a strong rebound last week after initial dive to 116.12. Notable support was seen ahead of 115.86 low. As the price actions from 116.12 low are not clearly impulsive yet, initial bias remains neutral this week first. On the upside, firm break of 121.39 will pave the way to 112.87 resistance next. On the downside, sustained break of 115.86 will indicate larger down trend resumption.

In the bigger picture, outlook remains bearish as the cross is staying well inside falling channel established since 137.49 (2018 high). As long as 122.87 resistance holds, the down trend should resume sooner or later to 114.84 support next. However, sustained break of 122.87 will complete a double bottom (115.86, 116.12) which could indicate medium term bullish reversal.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. This falling leg would target 109.48 (2016 low). With EUR/JPY staying below 55 month EMA (now at 125.35), this is the preferred case.