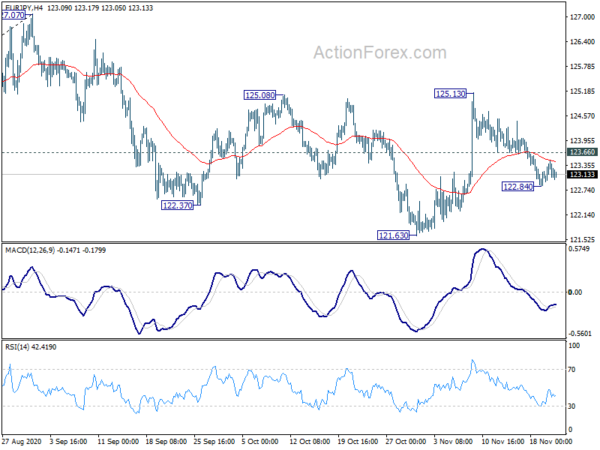

EUR/JPY’s decline last week argues that rebound from 121.63 has completed at 125.13, after rejection by 125.08 resistance. The development suggests that corrective pattern from 127.07 is extending another falling leg. Initial bias remains neutral this week first. Below 122.84 will target a test on 121.63 support. However, break of 123.66 will dampen this bearish view and turn bias back to the upside for 125.13 resistance first.

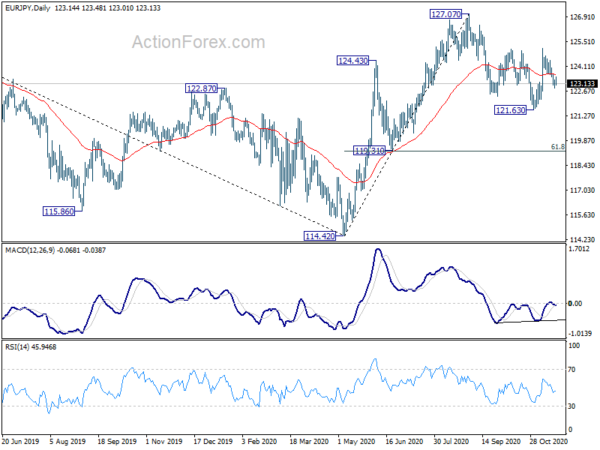

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 119.31 support holds. Break of 127.07 will target 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67 next. However, firm break of 119.31 will argue that the rise from 114.42 has completed and turn focus back to this low.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Another rising leg could have started for 137.49 resistance and above.