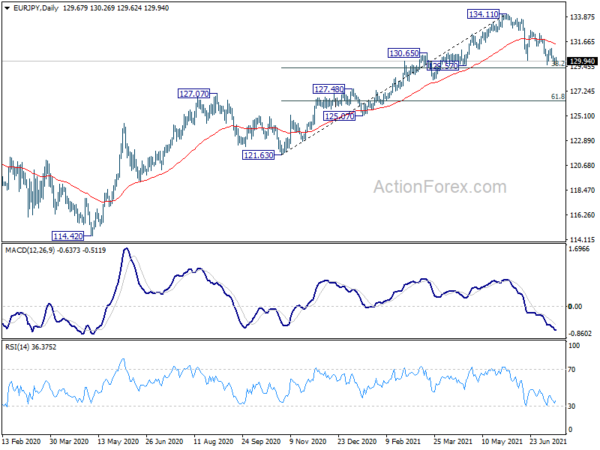

EUR/JPY was rejected by falling 4 hour 55 EMA last week and weakened again. Yet, downside was contained by 129.60 support. Initial bias remains neutral first. Corrective fall from 134.11 could extend lower. But we’d expect strong support from 38.2% retracement of 121.63 to 134.11 at 129.34 to bring rebound. On the upside, break of 131.07 resistance will indicate short term bottoming, and bring stronger rebound back to 132.68 resistance first. However, firm break of 129.34 will bring deeper fall back to 127.07 resistance turned support.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Next target is 137.49 (2018 high). Decisive break there will open up the possibility that it’s indeed resuming the up trend from 94.11 (2012 low). For now, outlook will stay bullish as long as 127.07 resistance turned support holds, in case of pull back.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Another rising leg in progress for 137.49 resistance and above.