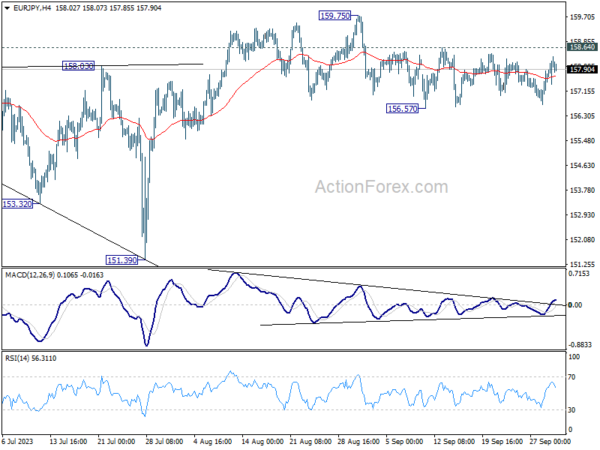

EUR/JPY extended the sideway patter from 156.57 last week and outlook is unchanged. Initial bias remains neutral this week for more consolidations. Deeper decline will remain in favor as long as 158.64 resistance holds. On the downside, break of 156.57 support, and sustained trading below 55 D EMA (now at 157.02) will argue that fall from 159.75 is a larger scale correction. Deeper decline would be seen back towards 151.39 support. Nevertheless, above 158.64 would bring retest of 159.75 high instead.

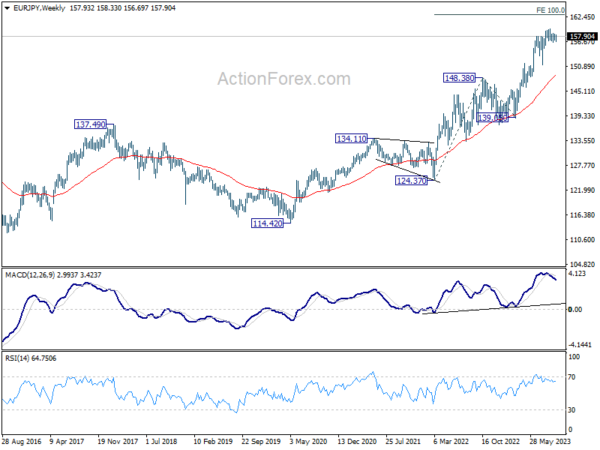

In the bigger picture, as long as 151.39 support holds, rise from 114.42 (2020 low) is still expected to continue. Next target is 100% projection of 124.37 to 148.38 from 139.05 at 163.06. Sustained break there will pave the way to retest long term resistance at 169.96.

In the long term picture, rise from 109.03 (2016 low) is seen as the third leg of the whole up trend from 94.11 (2012 low). Next target is 100% projection of 94.11 to 149.76 from 114.42 at 170.07 which is close to 169.96 (2008 high).