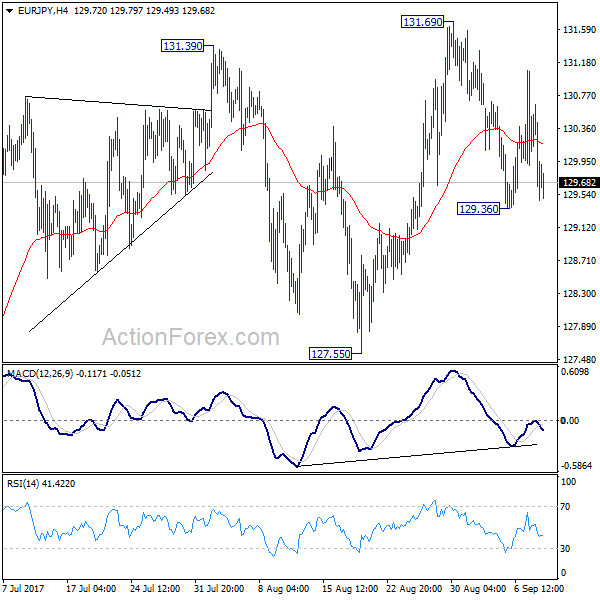

EUR/JPY edged lower to 129.36 last week but recovered since then. But overall, outlook remains unchanged that a short term top is in place at 131.69. Initial bias remains neutral tis week first. Break of 129.36 will turn bias to the downside for 127.55 support first. Firm break there will indicate near term reversal and deeper fall would be seen back to 122.39/125.80 support zone. In any case, we’d expect more corrective trading with risk of another fall, as long as 131.69 holds.

In the bigger picture, current rise from 109.03 is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). as long as 124.08 resistance turned support holds, further rise is expected to 61.8% retracement of 149.76 to 109.03 at 134.20. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. However, firm break of 124.08 will argue that rise from 109.03 is completed and turn outlook bearish.

In the long term picture, at this point, there is no clear indication that rise from 109.03 is resuming that from 94.11. Hence, we’d be cautious on topping below 149.76 to extend range trading. Nonetheless, firm break of 149.76 will indicates strong underlying buying. In such case, EUR/JPY will target 100% projection of 94.11 to 149.76 from 109.03 at 164.68.