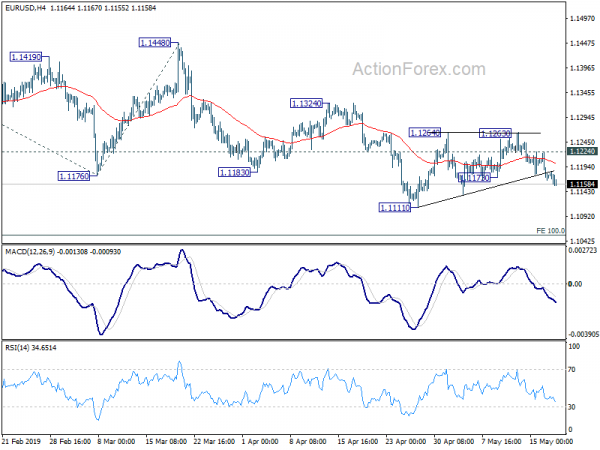

EUR/USD’s decline and break of 1.1173 support last week suggests that consolidation pattern from 1.1111 has completed at 1.1263, after hitting 55 day EMA. Initial bias remains on the downside this week for retesting 1.1111 first. Break will resume larger down trend for 100% projection of 1.1448 to 1.1183 from 1.1324 at 1.1059. Though, on the upside, above 1.1224 minor resistance will turn bias back to the upside to extend the consolidation from 1.1111 first.

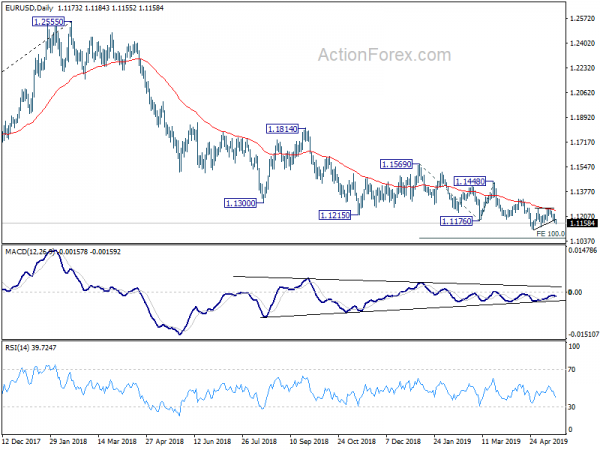

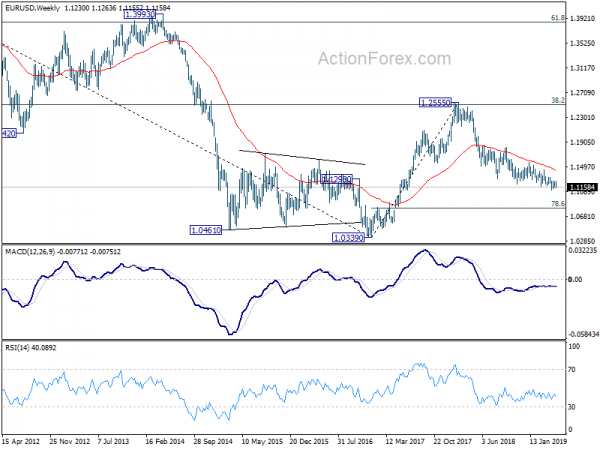

In the bigger picture, down trend from 1.2555 (2018 high) is still in progress. Such decline would target 78.6% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.0813 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1448 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

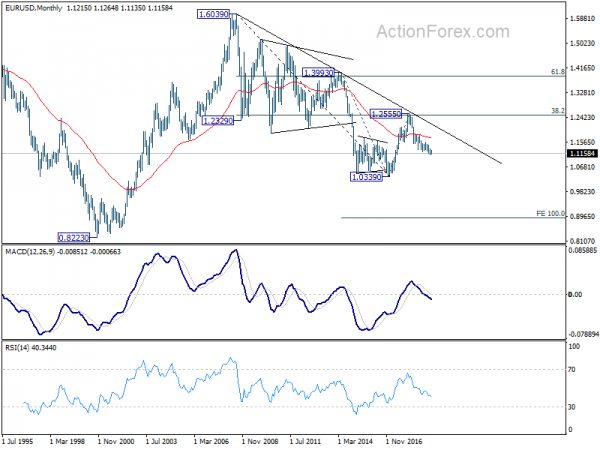

In the long term picture, the rejection from 38.2% retracement of 1.6039 to 1.0339 at 1.2516 argues that long term down trend from 1.6039 (2008 high) might not be over yet. EUR/USD is also held below decade long trend line resistance, 55 month and 55 week EMA. Break of 1.0339 will resume the down trend to 100% projection of 1.3993 to 1.0339 from 1.2555 at 0.9501