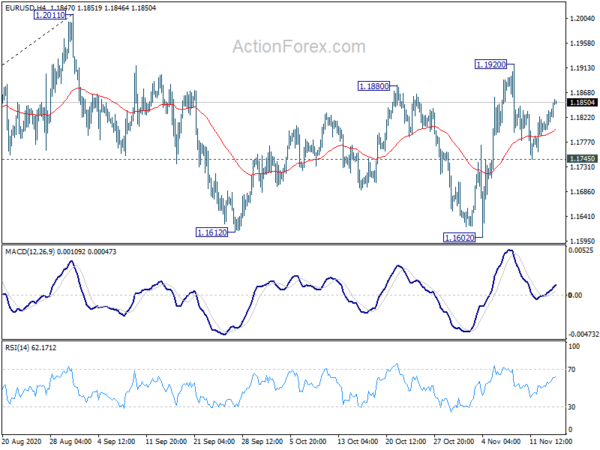

Daily Pivots: (S1) 1.1809; (P) 1.1823; (R1) 1.1847; More…..

Intraday bias in EUR/USD stays neutral at this point. On the upside, break of 1.1920 will reaffirm the case that consolidation from 1.2011 has completed at 1.1602. Further rise would be seen to retest 1.2011 high. However, break of 1.1745 support will turn bias to the downside to extend the consolidation with another falling leg.

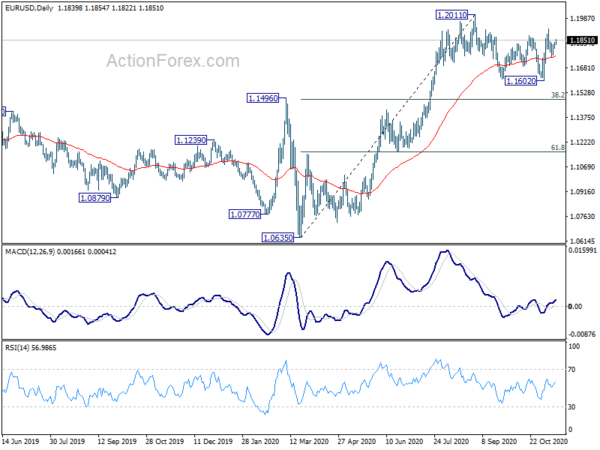

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1422 resistance turned support holds.