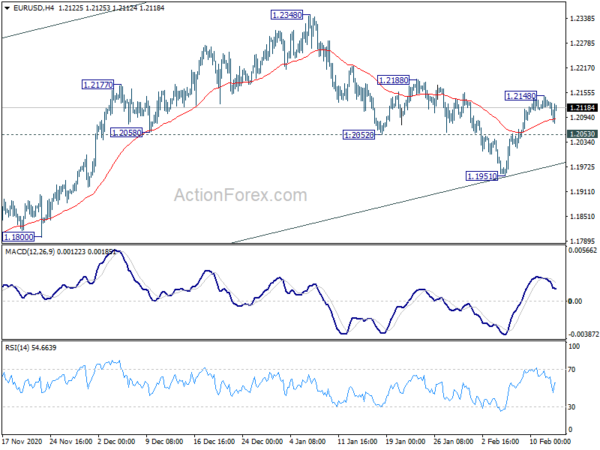

EUR/USD rebounded strongly to 1.2148 last week. While it retreated since then, some support was seen from 4 hour 55 day EMA and recovered. Initial bias is neutral this week first. On the upside, break of 1.2148 temporary top will reaffirm the case that correction from 1.2348 has completed with three waves down to 1.1951. Intraday bias will be back on the upside for 1.2188 and then 1.2348 high. However, break of 1.2053 minor support will dampen this bullish case and bring retest of 1.1951 support instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

In the long term picture, the case of long term bullish reversal continues to build up, with bullish convergence condition in monthly MACD, sustained trading above 55 month EMA and long trend falling trend line. Focus is now on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). Decisive break there will confirm and target 61.8% retracement at 1.3862 and above.