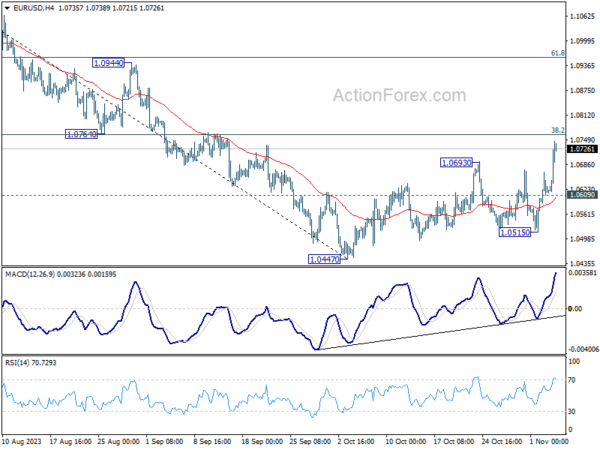

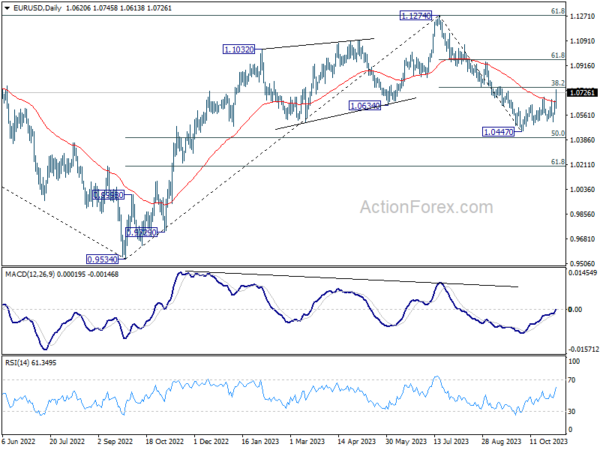

EUR/USD’s rebound from 1.0447 resumed last week and the break of 55 D EMA argues that fall from 1.1274 has completed. Initial bias stays on the upside this week for 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). Decisive break there will pave the way to 61.8% retracement at 1.0958 next. On the downside, below 1.0609 minor support will turn intraday bias neutral first.

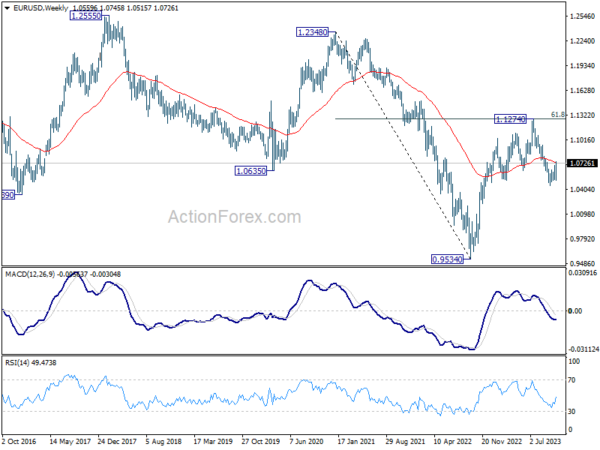

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern.

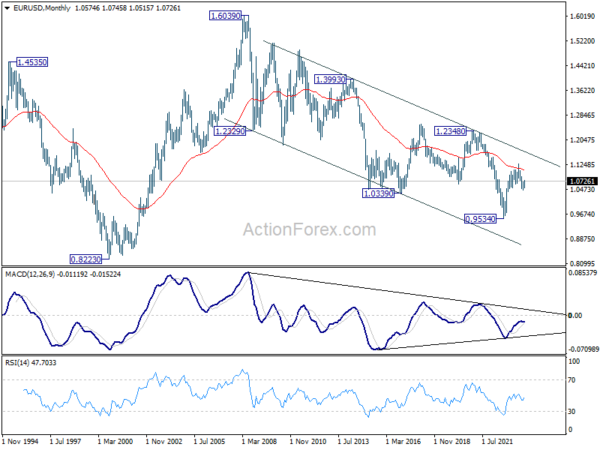

In the long term picture, sustained trading above 55 M EMA (now at 1.1087) is needed to be the first sign of bullish trend reversal. Decisive break of 1.2348 structural resistance is needed to confirm. Otherwise, outlook will be neutral at best.