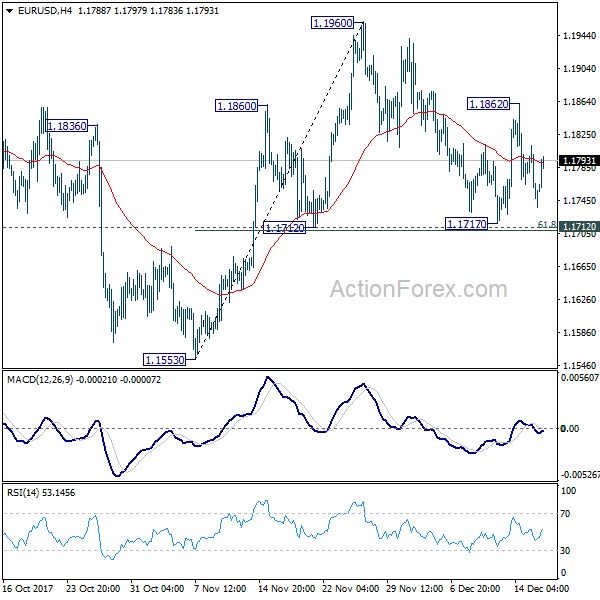

Daily Pivots: (S1) 1.1727; (P) 1.1770 (R1) 1.1791; More….

EUR/USD is staying in tight range despite today’s recovery. Intraday bias remains neutral at this point. Focus is on 1.1712 cluster support (61.8% retracement of 1.1553 to 1.1960 at 1.1708). Decisive break there should confirm completion of rebound from 1.1553 at 1.1960. This would also be supported by a head and shoulder pattern (ls: 1.1860; h: 1.1960; rs: 1.1862). And in that case, deeper fall should be seen through 1.1553 to extend the medium term decline from 1.2091. Meanwhile, above 1.1862 will revive near term bullishness and target 1.1960 and above.

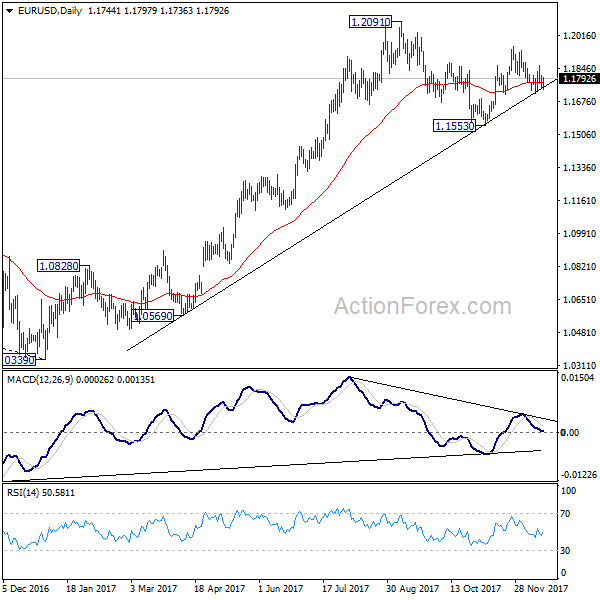

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1435) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.