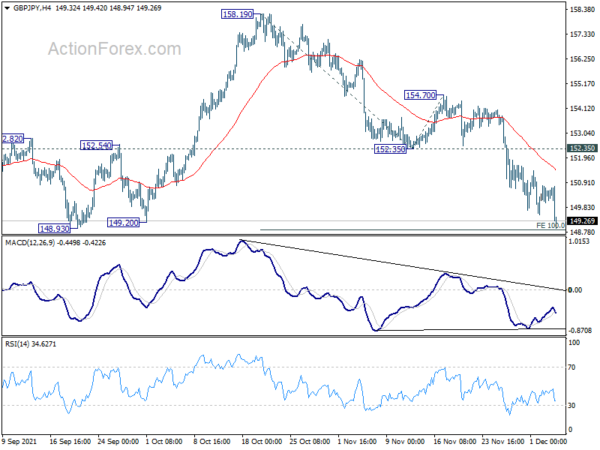

GBP/JPY’s fall from 158.19 continued last week and hit as low as 148.97. Initial bias is on the downside this week with focus on 100% projection of 158.19 to 152.35 from 154.70 at 148.86, which is close to 148.93 key structural support. Decisive break there will carry larger bearish implication and target 161.8% projection at 145.25 next. In any case, outlook will stay bearish as long as 152.35 support turned resistance holds, in case of recovery.

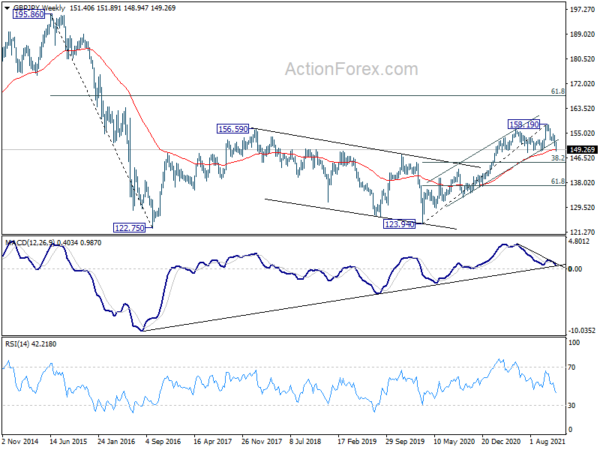

In the bigger picture, the break of medium term channel support, and bearish divergence condition in week MACD are raising the chance of medium term topping at 158.19. Firm break of 148.93 support will argue that GBP/JPY is at least correcting the whole rise from 123.94 (2020 low). In this case, deeper fall would be seen to 38.2% retracement of 123.94 to 158.19 at 145.10. Nevertheless, strong rebound from 148.93 will retain medium term bullishness for another rise through 158.19 at a later stage.

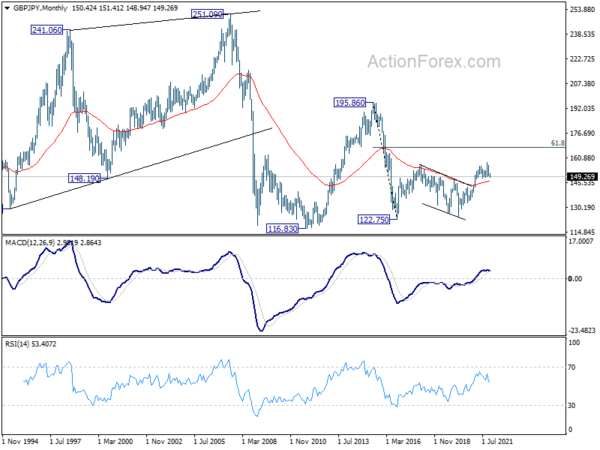

In the longer term picture, as long as 55 month EMA (now at 146.38) holds, we’d still favor more up trend to 61.8% retracement of 195.86 to 122.75 at 167.93. But sustained trading below 55 month EMA will at least neutralize medium term bullishness and re-open the chance of revisiting 122.75 low (2016 low).