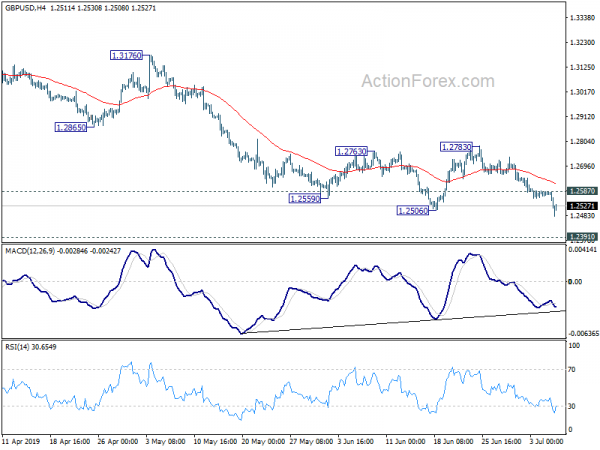

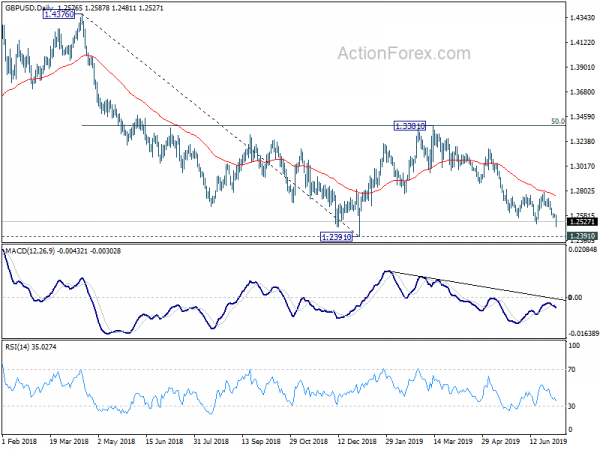

GBP/USD dropped further to as low as 1.2481 last week. Break of 1.2506 support indicate resumption of whole fall from 1.3381. The pair is also kept comfortably below falling 55 day EMA, maintaining near term bearishness. Initial stays on the downside this week for 1.2391 low. Firm break there will resume larger down trend. On the upside, above 1.2587 minor resistance will turn intraday bias neutral first. But near term outlook will stay bearish as long as 1.2783 resistance holds.

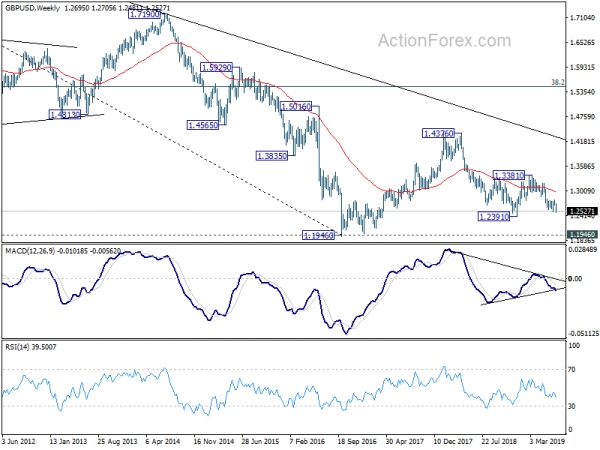

In the bigger picture, down trend from 1.4376 (2018 high) is still in progress. Break of 1.2391 would target a test on 1.1946 long term bottom (2016 low). For now, we don’t expect a firm break there yet. Hence, focus will be on bottoming signal as it approaches 1.1946. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

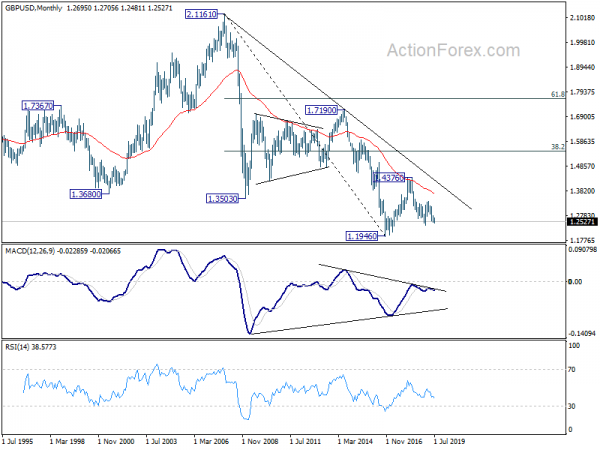

In the longer term picture, consolidative pattern from 1.1946 (2016 low) could still extend with another rising leg. But after all, decisive break of 38.2% retracement of 2.1161 (2007 high) to 1.1946 at 1.5466 is needed to indicate long term reversal. Otherwise, an eventual downside breakout will remain in favor.