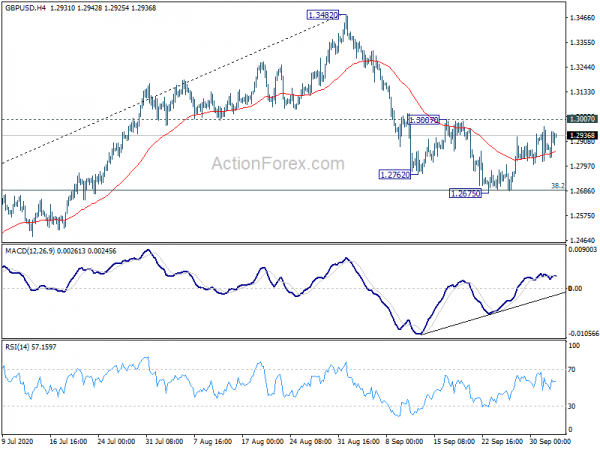

GBP/USD stayed in consolidation from 1.2675 last week and upside was limited below 1.3007 resistance. Initial bias stays neutral this week first and further decline is expected. On the downside, sustained break of 38.2% retracement of 1.1409 to 1.3482 at 1.2690 will argue that the rise from 1.1409 might be completed, and bring deeper fall to 61.8% retracement at 1.2201. However, break of 1.3007 resistance will suggest that decline from 1.3482 is merely a corrective move, and turn bias back to the upside for retesting 1.3482.

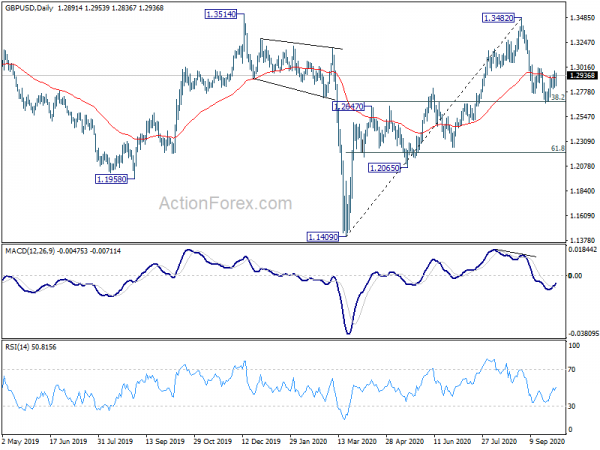

In the bigger picture, while the rebound from 1.1409 was strong, it’s limited by both 1.3514 resistance, as well as 55 month EMA (now at 1.3317). The development keeps outlook bearish. Sustained break of 55 week EMA (now at 1.2749) will add to medium term bearishness for a new low below 1.1409 at a later stage, resuming the down trend from 2.1161 (2007 high).

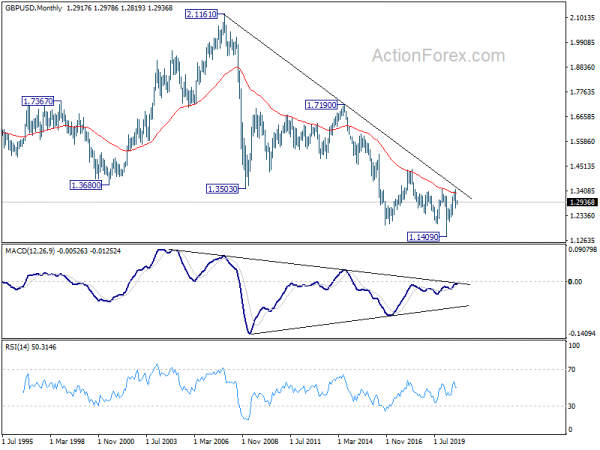

In the longer term picture, GBP/USD is staying below decade long trend line from 2.1161 (2007 high). It also struggles to sustain above 55 month EMA (now at 1.3317). Long term outlook stays bearish for now, despite bullish convergence condition in monthly MACD.