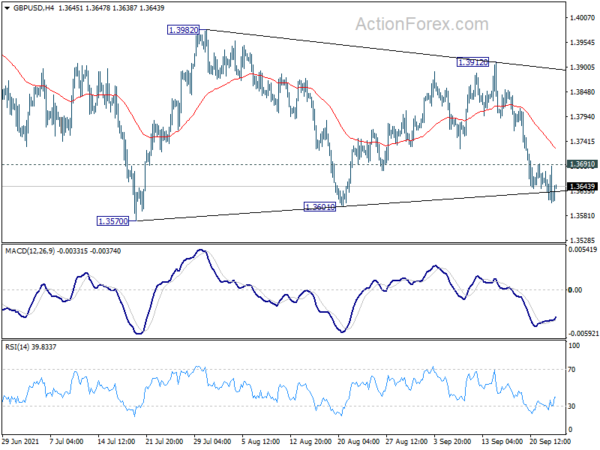

Daily Pivots: (S1) 1.3588; (P) 1.3639; (R1) 1.3668; More…

GBP/USD continues to lose downside momentum as seen in 4 hour MACD. But with 1.3691 minor resistance intact, further decline is still expected. Larger fall from 1.4248 is likely resuming and break of 1.3570 will target 1.3482 key support level. Sustained break there will carry larger bearish implication and target 1.3163 fibonacci level. On the upside, above 1.3691 minor resistance will turn intraday bias back to the upside for 1.3912 resistance instead.

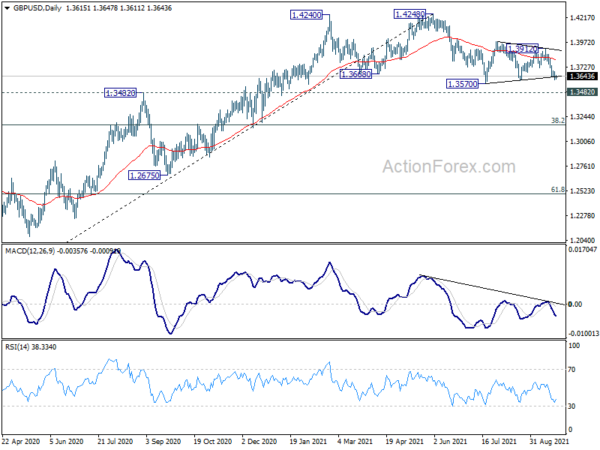

In the bigger picture, as long as 1.3482 resistance turned support holds, we’d still treat price actions from 1.4248 as a corrective move. That is, up trend from 1.1409 (2020 low) is in favor to resume. Decisive break of 1.4376 key resistance (2018 high) would indeed carry long term bullish implications. However, sustained break of 1.3482 will at least bring deeper fall to 38.2% retracement of 1.1409 to 1.4248 at 1.3164, or even further to 61.8% retracement at 1.2493.