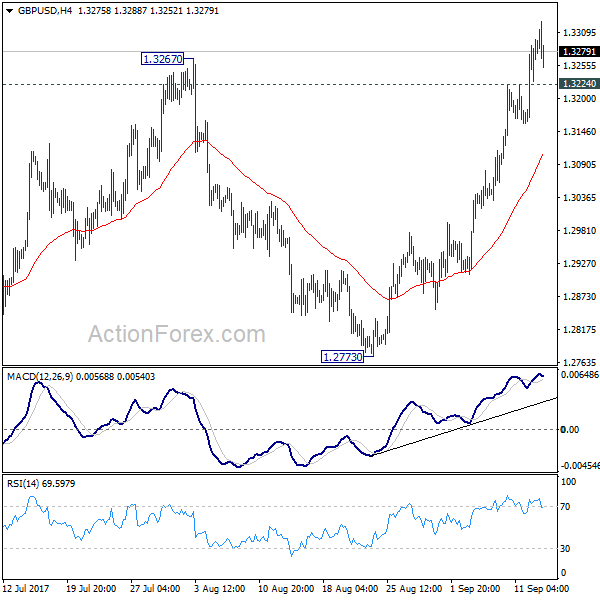

Daily Pivots: (S1) 1.3193; (P) 1.3245; (R1) 1.3334; More…

GBP/USD lost momentum after hitting 1.3328 and retreated. But with 1.3224 minor support intact, intraday bias stays on the upside. Current rally is expected to target 1.3444 key resistance next. At this point, we’d maintain that price actions from 1.1946 are still seen as a corrective pattern. Hence, we’d expect strong resistance from 1.3444 to limit upside to bring larger down trend reversal eventually. On the downside below, 1.3224 minor support will turn intraday bias neutral again. However, firm break of 1.3444 will carry larger bullish implication and target 1.3835/5016 resistance first zone first.

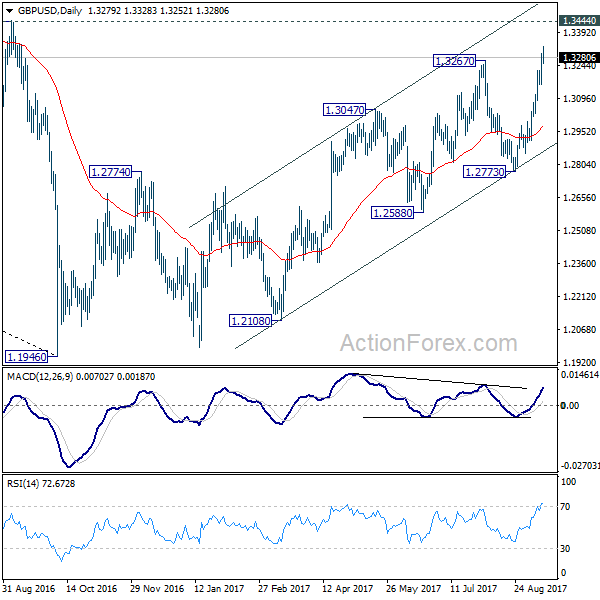

In the bigger picture, overall, price actions from 1.1946 medium term low are seen as a corrective pattern. While further rise cannot be ruled out, larger outlook remains bearish as long as 1.3444 key resistance holds. Down trend from 1.7190 (2014 high) is expected to resume later after the correction completes. And break of 1.2773 support will be the first sign that such down trend is resuming. However, considering bullish convergence condition in monthly MACD, firm break of 1.3444 will argue that whole down trend from 2.1161 (2007) has completed. And stronger rise would be seen back to 38.2% retracement of 2.1161 to 1.1946 at 1.5466.