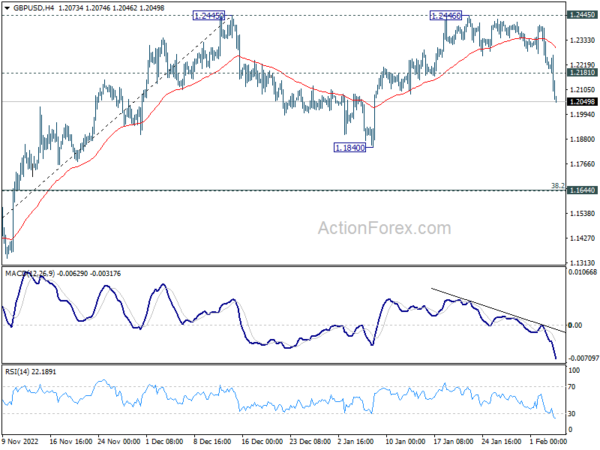

GBP/USD’s decline last week confirmed that rebound from 1.1840 has completed at 1.2446, after rejection by 1.2445 resistance. Corrective pattern from 1.2445 should now be in its third leg. Initial bias stays on the downside for 1.1840 support and possibly below. But downside downside should be contained by 38.2% retracement of 1.0351 to 1.2445 at 1.1645 to bring rebound. On the upside, above 1.2181 minor resistance will turn intraday bias neutral first. But risk will stay mildly on the downside as long as 1.2445/6 holds, in case of recovery.

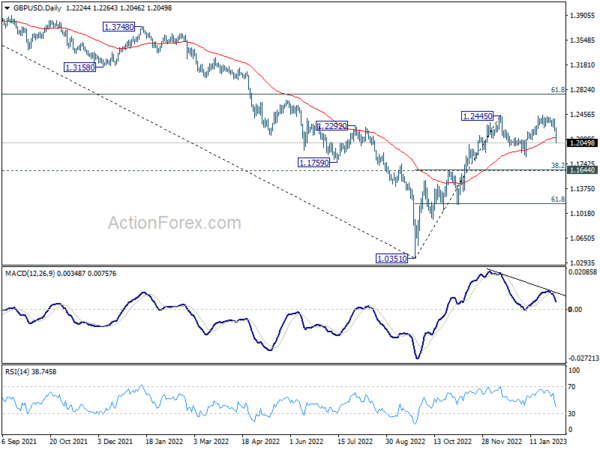

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.

In the longer term picture, as long as 1.4248 resistance holds (2021 high), long term outlook will remain neutral at best. Down trend from 2.1161 (2007) could still resume for another low through 1.0351 at a later stage.