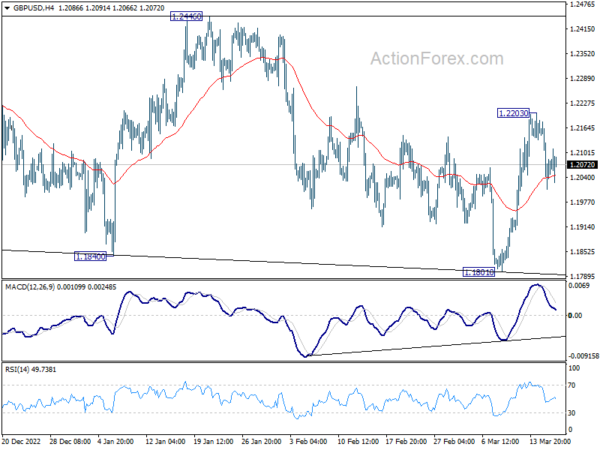

Daily Pivots: (S1) 1.1983; (P) 1.2083; (R1) 1.2154; More…

Intraday bias in GBP/USD remains neutral and outlook is unchanged. Corrective pattern from 1.2445 could have completed with three waves to 1.1801 already. On the upside, above 1.2203 will resume the rally from 1.2445/6 resistance zone next. However, decisive break of 4 hour 55 EMA (now at 1.2042) will argue that the pattern from 1.2445 is extending with another falling leg, and turn bias to the downside for 1.1801 again.

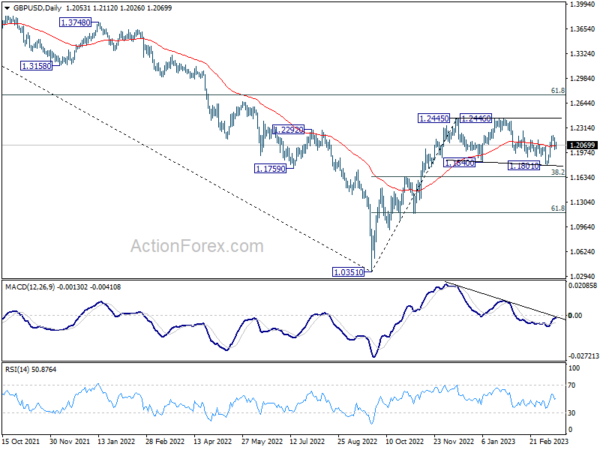

In the bigger picture, price action from 1.2445 are seen as a corrective pattern to rise from 1.0351 medium term bottom (2022 low). Resumption is expected as a later stage and firm break of 1.2446 will target 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. This will remain the favored case as long as 38.2% retracement of 1.0351 to 1.2445 at 1.1645 holds.