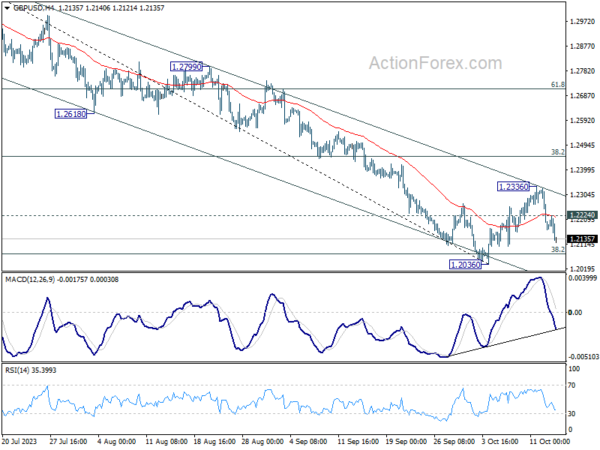

GBP/USD’s rebound from 1.2036 extended higher last week but was rejected by near term falling channel resistance, and fell notably since then. Initial bias remains on the downside this week for retesting 1.2036. Firm break will resume whole decline from 1.3141 for 1.1801 support next. On the upside, above 1.2224 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.2336 resistance holds.

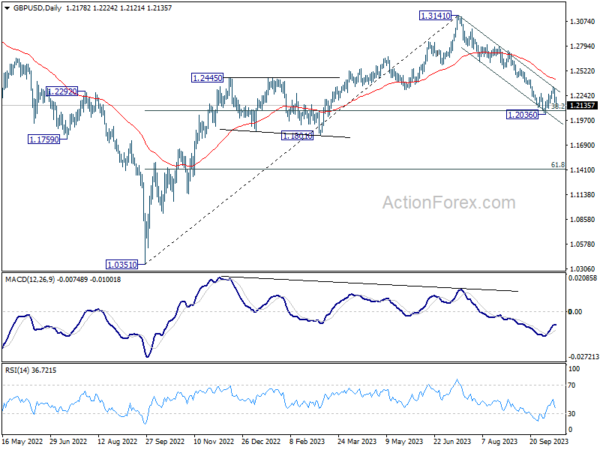

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2418) holds, in case of rebound.

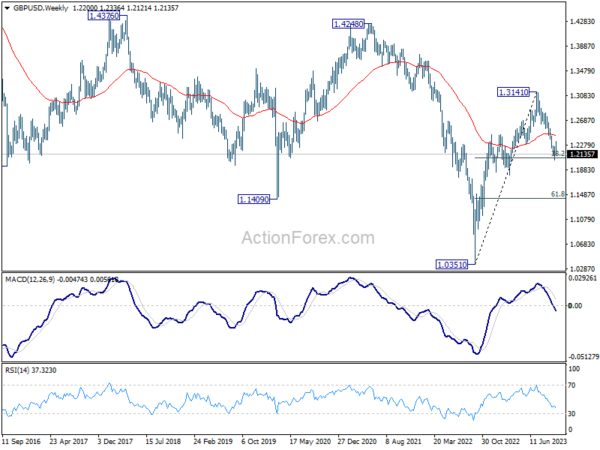

In the long term picture, there is no clear sign of trend reversal yet. Rise from 1.0351 could be part of a consolidation pattern to down trend from 2.1161 (2007 high). Rejection by 55 M EMA (now at 1.2900) will retain long term bearishness for extending the down trend at a later stage.