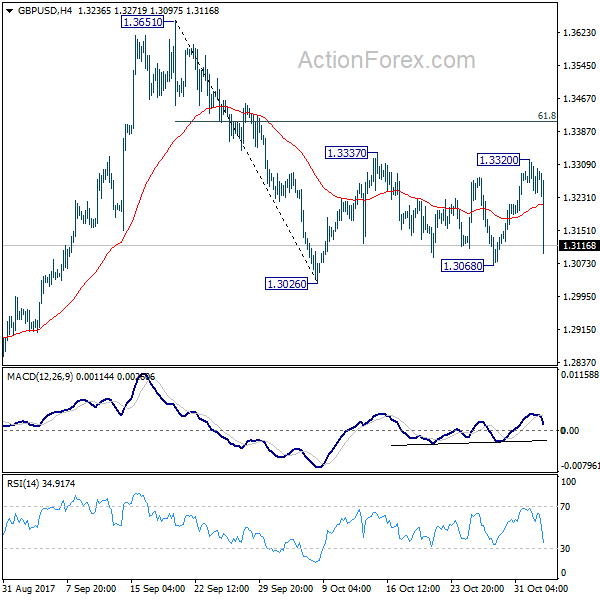

Daily Pivots: (S1) 1.3216; (P) 1.3268; (R1) 1.3297; More….

GBP/USD failed to break out 1.3337 resistance, reversed after hitting 1.3320 and drops sharply from there. At this point, it’s staying in consolidation pattern from 1.3026 short term bottom. Intraday bias remains neutral first. Outlook is unchanged that even in case of another rise, upside should be limited by 61.8% retracement of 1.3651 to 1.3026 at 1.3412 to bring fall resumption finally. On the downside, firm break of 1.3026 support will resume the decline from 1.3651 and target 1.2773 key support level. This will also revive the case of medium term reversal. However, sustained break of 1.3412 will turn focus back to 1.3651 high.

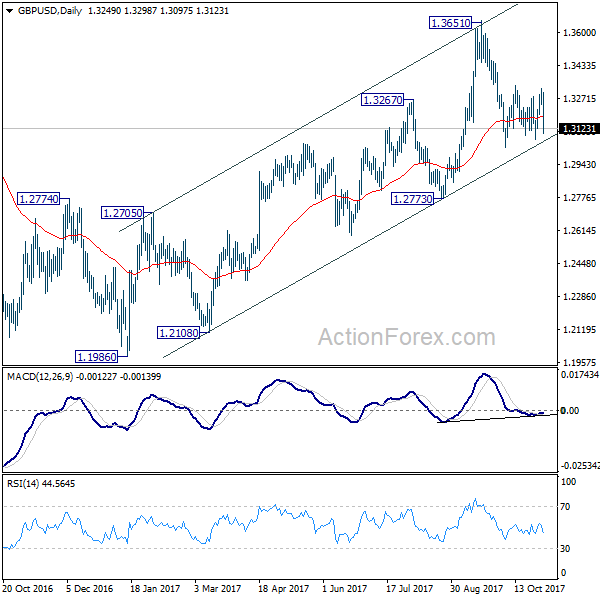

In the bigger picture, while the medium term rebound from 1.1946 was strong, GBP/USD hit strong resistance from the long term falling trend line. Outlook is turned a bit mixed and we’ll stay neutral first. On the downside, decisive break of 1.2773 key support will argue that rebound from 1.1946 has completed. The corrective structure of rise from 1.1946 to 1.3651 will in turn suggest that long term down trend is now completed. Break of 1.1946 low should then be seen. On the upside, break of 1.3835 support turned resistance will revive the case of trend reversal and target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466 .