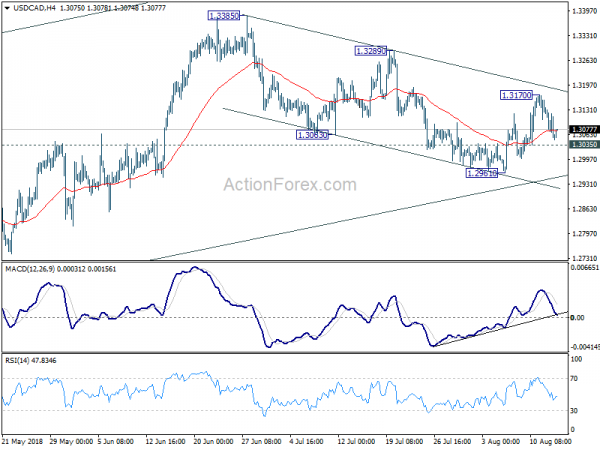

Daily Pivots: (S1) 1.3030; (P) 1.3083; (R1) 1.3111; More…

Intraday bias in USD/CAD remains neutral for the moment. With 1.3035 minor support intact, we’re favoring the bullish case. That is, correction from 1.3385 should have completed with three waves down to 1.2961. Above 1.3170 will target 1.3289 resistance first. Break there will resume larger rise from 1.2061 through 1.3385 high. On the downside, though, break of 1.3035 minor support will dampen this bullish view and turn focus back to 1.2961 low.

In the bigger picture, as long as channel support (now at 1.2950) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.