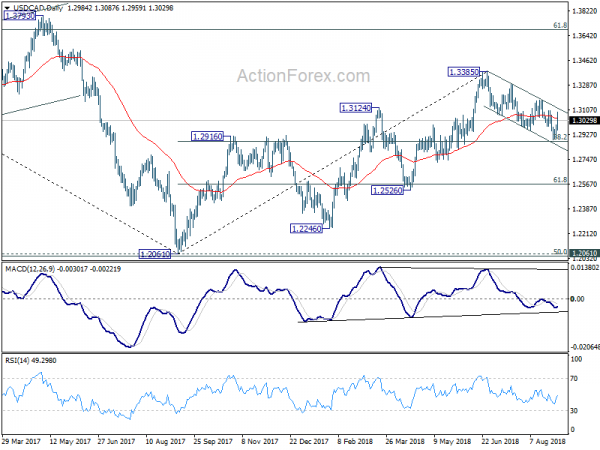

USD/CAD’s choppy fall from 1.3385 extended lower to 1.2886 last week. But it quickly recovered ahead of 1.2879 fibonacci level. Near term outlook is mixed up. Initial bias is mildly on the upside this week as long as 1.2997 minor support holds. Sustained of near term channel resistance (now at 1.3111) will will be the first sign of bullish reversal and bring stronger rise to 1.3173 resistance for confirmation. That will also carry larger bullish implication. Meanwhile, below 1.2997 minor support will turn bias back to the downside for 1.2879 fibonacci level.

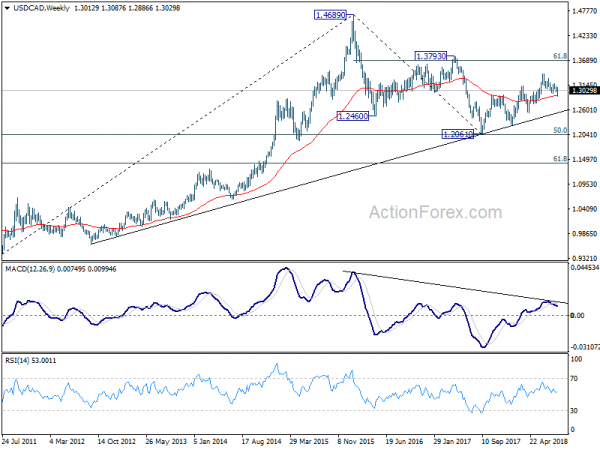

In the bigger picture, focus is now on 38.2% retracement of 1.2061 to 1.3385 at 1.2879. Decisive break there will affirm the case of medium term reversal and target 61.8% retracement at 1.2567 and below. That will also put key long term support at 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048 into focus. On the upside, break of 1.3173 resistance will revive the bullish case and target 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above.

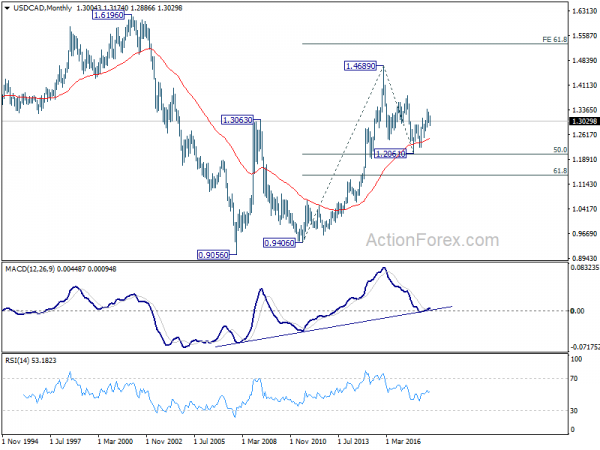

In the longer term picture, corrective fall from 1.4689 (2015 high) should have completed with three waves down to 1.2061, just ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. The development keeps long term up trend from 0.9406 and that from 0.9056 (2007 low) intact. For now, there is now prospect of extending the long term up trend to 61.8% projection of 0.9406 to 1.4689 from 1.2061 at 1.5326 in medium to long term.