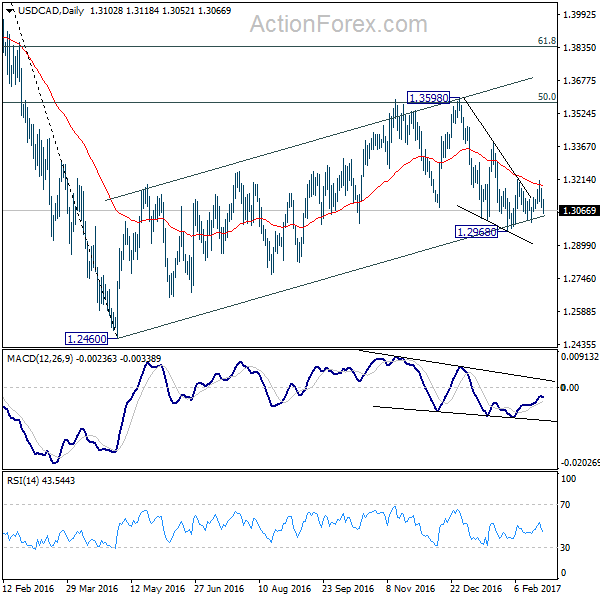

Daily Pivots: (S1) 1.3067; (P) 1.3118; (R1) 1.3154; More…

USD/CAD dips sharply today but stays in range of 1.2968/3211. Intraday bias remains neutral first. On the upside, break of 1.3211 resistance will argue that fall from 1.3598 has completed at 1.2968. And more importantly, rise from 1.2460 is still in progress. In that case, intraday bias will be turned back to the upside for 1.3598 and above. On the downside, below 1.2968 will revive the case that rise from 1.2460 is completed and turn outlook bearish for this low. Overall, choppy rise from 1.2460 is still seen as a corrective move.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg could be completed at 1.3598 and fall from there is tentatively seen as the third leg. Break of 1.2460 will target 50% retracement of 0.9460 to 1.4689 at 1.2075 before completing the correction. In case of another rise, we’d look for reversal signal above 61.8% retracement of 1.4689 to 1.2460 at 1.3838.