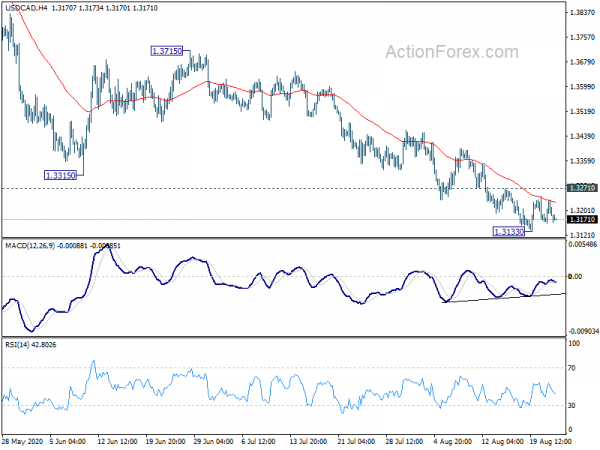

Daily Pivots: (S1) 1.3154; (P) 1.3194; (R1) 1.3229; More….

Intraday bias in USD/CAD remains neutral for consolidations. Further decline is expected as long as 1.3271 resistance holds. Break of 1.3133 will resume larger fall from 1.4667 to long term fibonacci level at 1.3056. On the upside, considering bullish convergence condition, firm break of 1.3271 should confirm short term bottoming. Intraday bias will be turned back to the upside for rebound to 55 day EMA (now at 1.3439).

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement of 1.2061 to 1.4667 at 1.3056 and possibly below. This will now remain the favored case as long as 1.3715 resistance holds. However, sustained break of 1.3715 will turn focus back to 1.4689 key resistance.