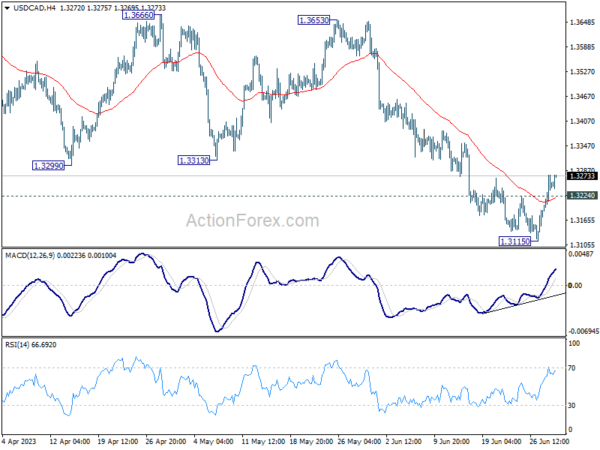

Daily Pivots: (S1) 1.3207; (P) 1.3242; (R1) 1.3294; More….

USD/CAD’s break of 1.3224 minor resistance should confirm short term bottoming at 1.3115, on bullish convergence condition in 4H MACD. Intraday bias is back on the upside for 1.3229 support turned resistance. Firm break there will extend the rebound to 55 D EMA (now at 1.3389). On the downside, break of 1.3115 is needed to confirm resumption of recent decline. Otherwise, more consolidative trading should be seen first, in case of retreat.

In the bigger picture, price actions from 1.3976 are still viewed as a correction to up trend from 1.2005 (2021 low), but chance of trend reversal is increasing with current decline. In either case, risk will stay on the downside as long as 1.3299 support turned resistance holds, even in case of strong rebound. Next target is 61.8% retracement of 1.2005 to 1.3976 at 1.2758. Sustained trading above 1.3229 will raise the chance that the correction has completed and turn focus back to 1.3653 resistance.