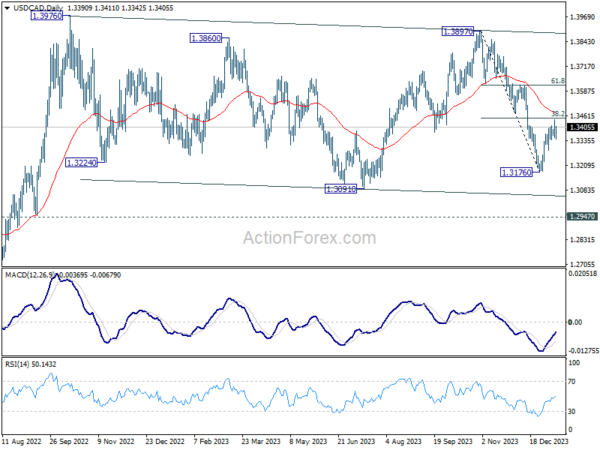

USD/CAD’s rebound from 1.3176 short term bottom extended higher last week but lost momentum ahead of 38.2% retracement of 1.3897 to 1.3176 at 1.3451. Initial bias is turned neutral this week first. Further rise is mildly in favor as long as 1.3339 minor support holds. Decisive break of 1.3451 will pave the way to 61.8% retracement at 1.3622. On the downside, however, break of 1.3339 will turn bias back to the downside for 1.3176 low instead.

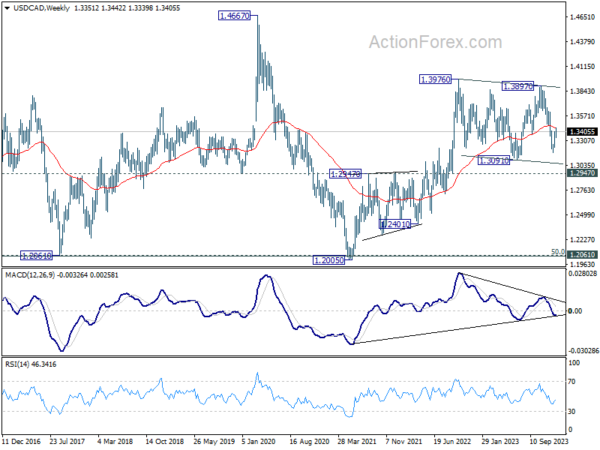

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. While fall from 1.3897 could still extend through 1.3091, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume at a later stage.

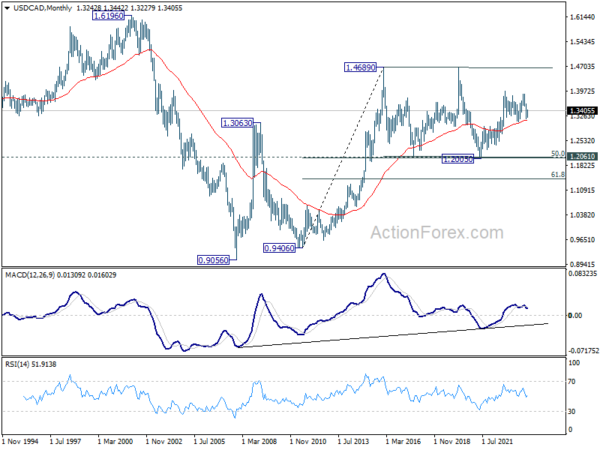

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2947 resistance turned support holds.