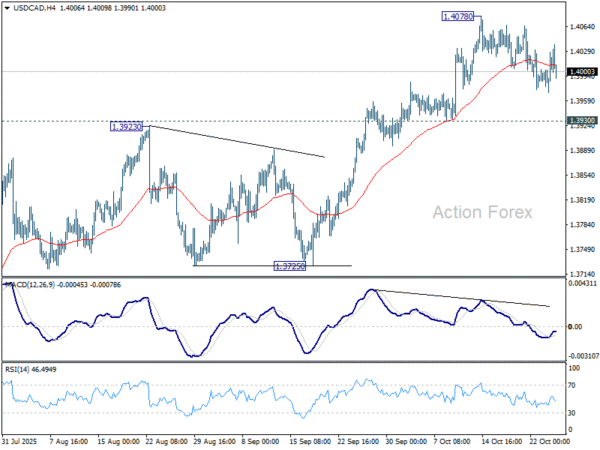

USD/CAD stayed in consolidations last week and outlook is unchanged. Initial bias remains neutral this week, and further rally is expected as long as 1.3930 support holds. Break of 1.4078 will resume the rise from 1.3538 to 61.8% retracement of 1.4791 to 1.3538 at 1.4312.

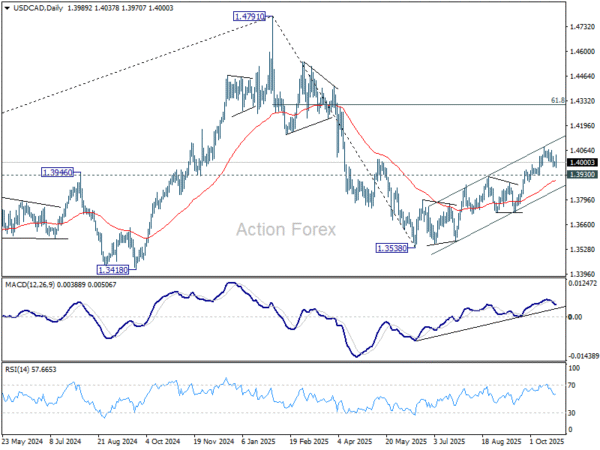

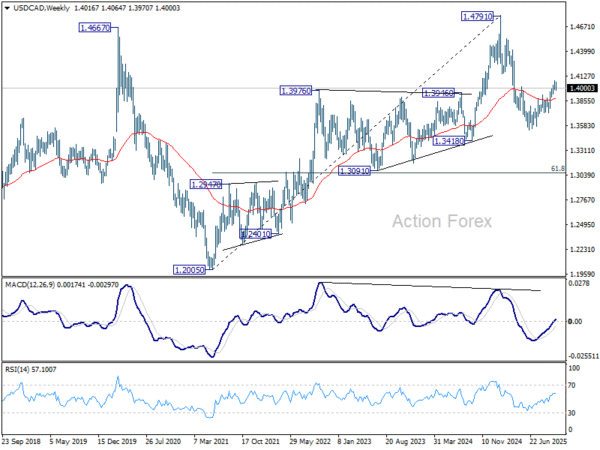

In the bigger picture, price actions from 1.4791 medium term top is likely just unfolding as a correction to up trend from 1.2005 (2021 low). Based on current momentum, rise from 1.3538 is the second leg, and a third leg should follow before up trend resumption. That is, range trading is set to extend for the medium term. For now, this will remain the favored case as long as 1.3725 support holds.

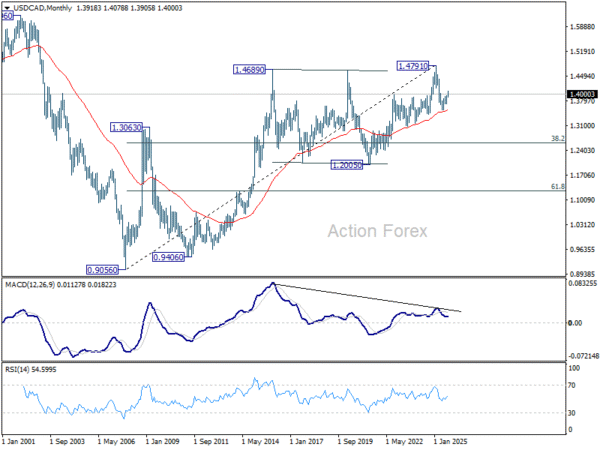

In the long term picture, 55 M EMA (now at 1.3525) remains intact. Thus, up trend from 0.90567 (2007 low) should still be in progress. However, considering bearish divergence condition M MACD, sustained trading below 55 M EMA will argue that the up trend has completed with five waves up to 1.4791, and turn medium term outlook bearish for correction.