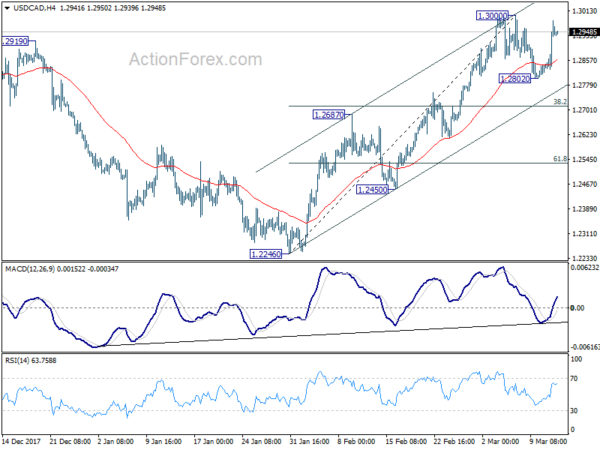

Daily Pivots: (S1) 1.2869; (P) 1.2926; (R1) 1.3023; More….

While the rebound from 1.2802 was strong, it’s limited below 1.3000 resistance. Intraday bias in USD/CAD remains neutral first. On the upside, break of 1.3000 will resume medium term rebound from 1.2061 and target 1.3065 medium term fibonacci level. On the downside, in case of another decline as consolidation from 1.3000 extends, we’d expect strong support from 38.2% retracement of 1.2246 to 1.3000 at 1.2712 to contain downside and bring rise resumption.

In the bigger picture, we’re favoring the medium term bullish case. That is larger down trend from 1.4689 has completed at 1.2061, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen back to 38.2% retracement of 1.4689 to 1.2061 at 1.3065 first. Break will target 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2687 support holds.