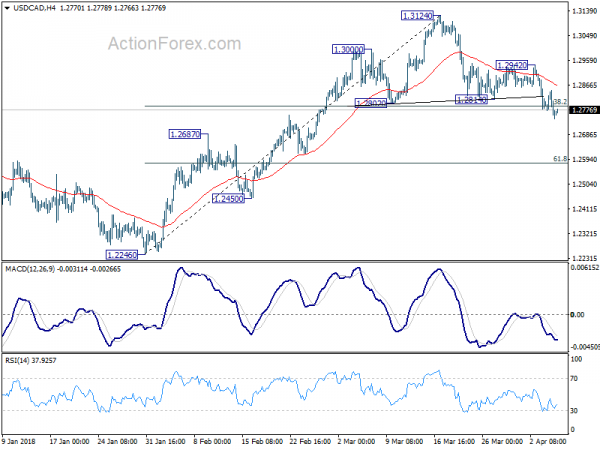

Daily Pivots: (S1) 1.2732; (P) 1.2789; (R1) 1.2822; More….

USD/CAD drops to as low as 1.2744 so far as decline from 1.3124 extends. The break of 38.2% retracement of 1.2246 to 1.3124 at 1.2789 should confirm near term reversal, with head and shoulder top pattern (ls: 1.3000; h: 1.3124; rs: 1.2942). Intraday bias stays on the downside for 61.8% retracement at 1.2581 next. Also, noted that current development suggest rejection by 1.3065 fibonacci level. And deeper decline could be seen back to 1.2246 and below eventually. On the upside, break of 1.2942 is needed to confirm completion of the decline. Otherwise, outlook will stay cautiously bearish in case of recovery.

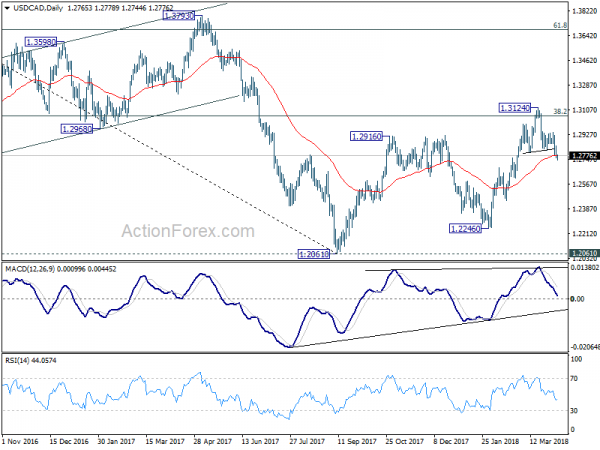

In the bigger picture, outlooks is turned a bit mixed again. Strong support was seen from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. But there was no follow through buying above 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Rejection by 1.3065 will argue that price action from 1.2061 is merely a three wave corrective pattern. And 1.2061 will be put back into focus with medium term bearishness revived.