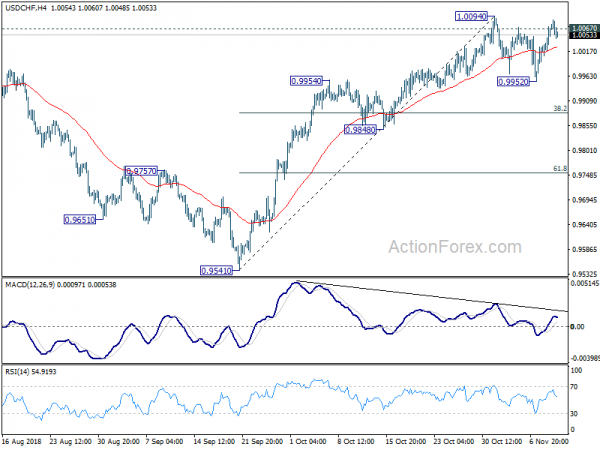

USD/CHF’s correction from 1.0094 extended to 0.9952 last week then rebound strongly from there. Nonetheless, upside is still limited below 1.0094 resistance. Initial bias is neutral this week first. In case of another fall through 0.9952, downside should be contained by 38.2% retracement of 0.9541 to 1.0094 at 0.9883 to contain downside to bring rebound. On the upside, break of 1.0094 and sustained trading above 1.0067 will confirm resumption of whole rise from 0.9541. USD/CHF should then target 1.0342 key resistance next.

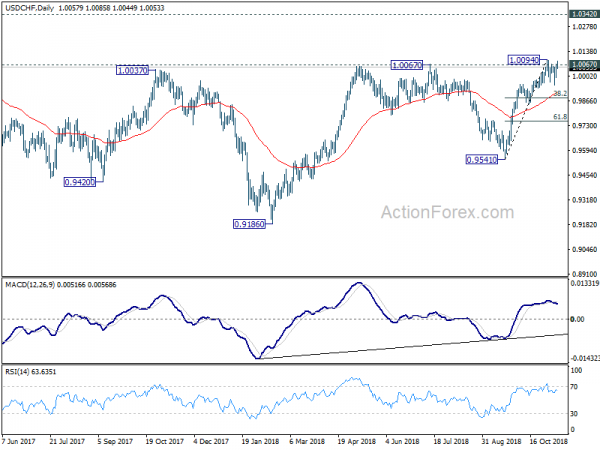

In the bigger picture, the pullback from 1.0067 has completed at 0.9541 already. And rise from 0.9186 is likely resuming. Firm break of 1.0067 will pave the way to retest 1.0342 key resistance. We’d be cautious on strong resistance from there to limit upside to bring another medium term fall to extend long term range trading. However, firm break of 0.9848 near term support will dampen this view and bring deeper decline back to 0.9541 support and possibly below.

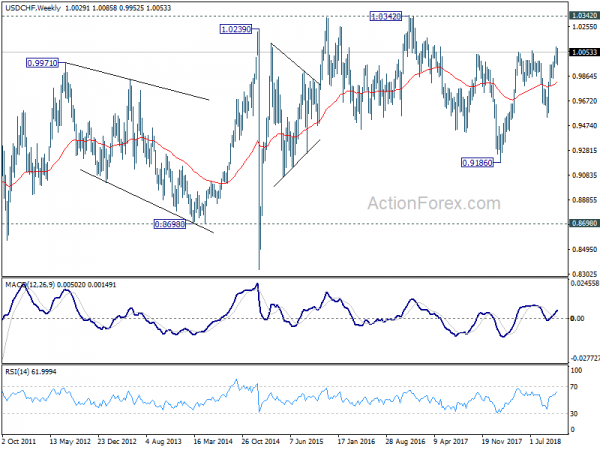

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.