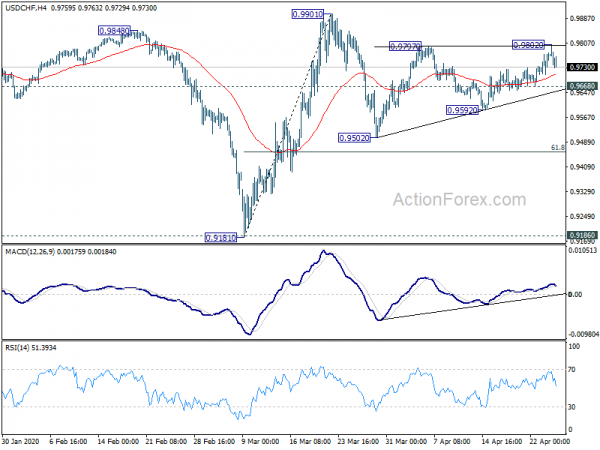

USD/CHF recovered to 0.9802 last week but failed to sustain above 0.9797 resistance. Initial bias remains neutral this week first. The current development suggests that consolidation from 0.9901 is still extending. On the downside, break 0.9668 minor support will start the third leg towards 0.9502 support. But downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, above 0.9802 will target a test on 0.9901 resistance next.

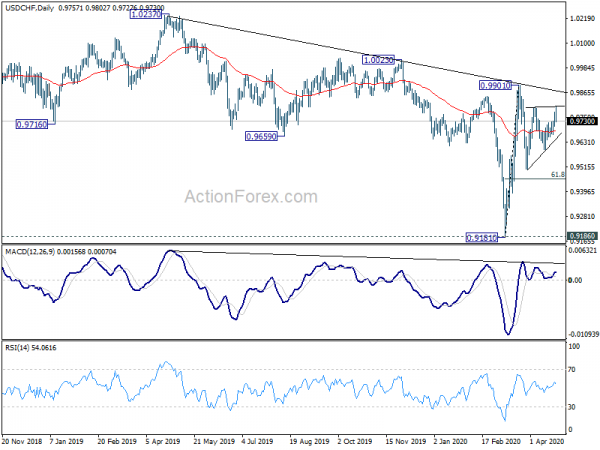

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.

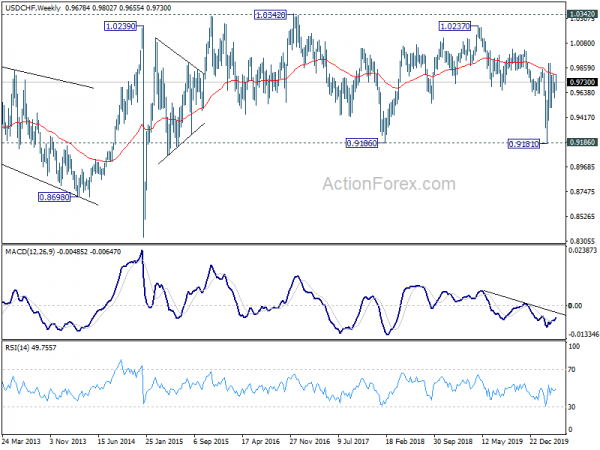

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.