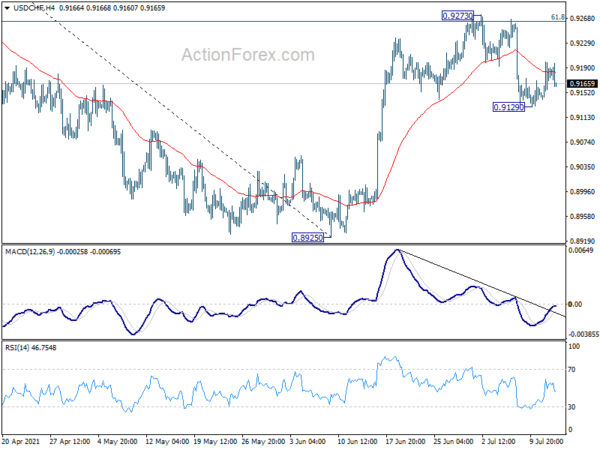

Daily Pivots: (S1) 0.9153; (P) 0.9177; (R1) 0.9211; More….

USD/CHF weakens after failing to sustain above 4 hour 55 EMA, but downside is contained well above 0.9129 support. Intraday bias remains neutral first. Risk is mildly on the downside with 0.9273 resistance intact. On the downside, sustained trading below 55 day EMA (now at 0.9126) will affirm the case that rebound from 0.8925 has completed at 0.9273. Deeper fall would then be seen back to retest 0.8925 low. On the upside though, break of 0.9273 and sustained trading above 61.8% retracement of 0.9471 to 0.8925 at 0.9262 will target 0.9471 resistance next.

In the bigger picture, medium term outlook is currently neutral with focus on 0.9471 resistance. Sustained break there will indicate completion of whole decline from 1.0342 (2016 high). Medium term outlook will be turned bullish for a test on 1.0342 high. But, rejection by 0.9471 again will revive bearishness for another fall through 0.8756 low.