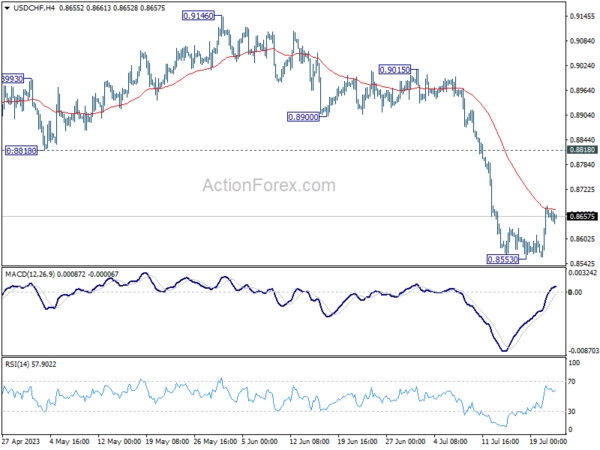

USD/CHF’s rebound last week suggests short term bottoming at 0.8853. Initial bias stays mildly on the upside for 0.8818 support turned resistance. Rejection by 0.8818 will retain near term bearishness for another decline through 0.8553. Meanwhile for now, risk will stay mildly on the upside as long as 0.8553 holds, in case of retreat.

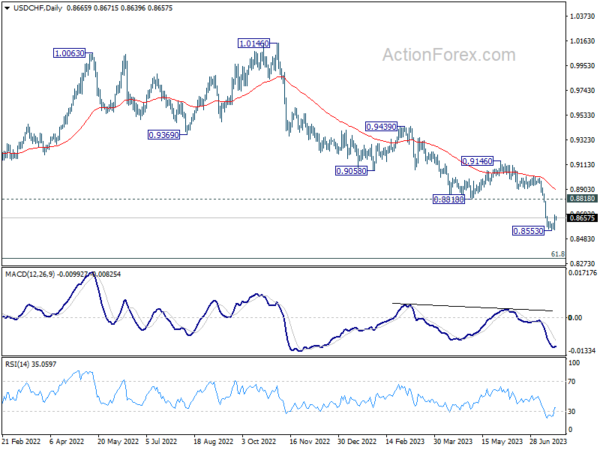

In the bigger picture, the break of 0.8756 (2021 low) indicates break out from the long term range pattern. For now, medium term outlook will stay bearish as long as 0.9146 resistance holds. Further fall would be seen to 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 next.

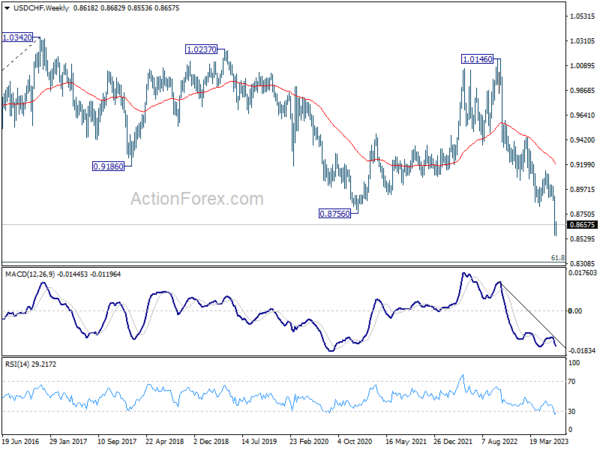

In the long term picture, there is no clear sign that down trend from 1.8305 (2000 high) has completed. With 38.2% retracement of 1.8305 to 0.7065 at 1.1359 intact, outlook is neutral at best. Sustained break of 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 will bring retest of 0.7065 low.