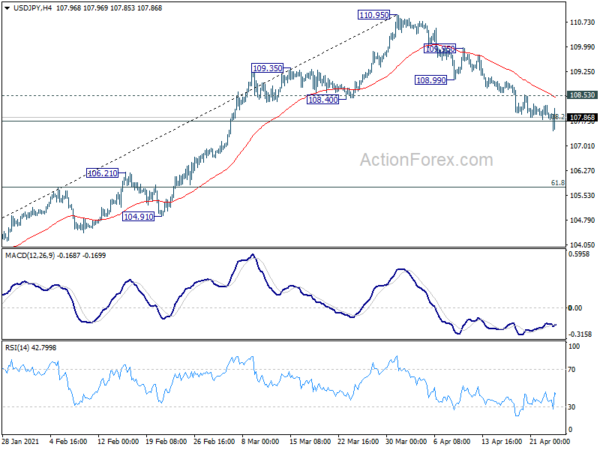

USD/JPY dropped further to as low as 107.47 last week and there is no clear sign of bottoming yet. Further fall is expected this week for 61.8% retracement of 102.58 to 110.95 at 105.77. On the upside, break of 108.53 minor resistance is needed to indicate short term bottoming. Otherwise, deeper decline will remain in favor in case of recovery.

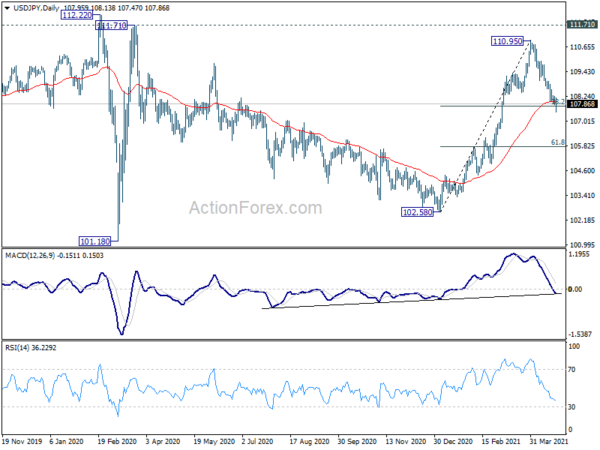

In the bigger picture, rise from 102.58 might have completed at 110.95, as the third leg of the pattern from 101.18 low. Medium term outlook is neutral first, as the pair could have turned into sideway trading between 101.18/111.71. We’d look at the structure and momentum of the fall from 110.95 to gauge the chance of upside breakout at a later stage.

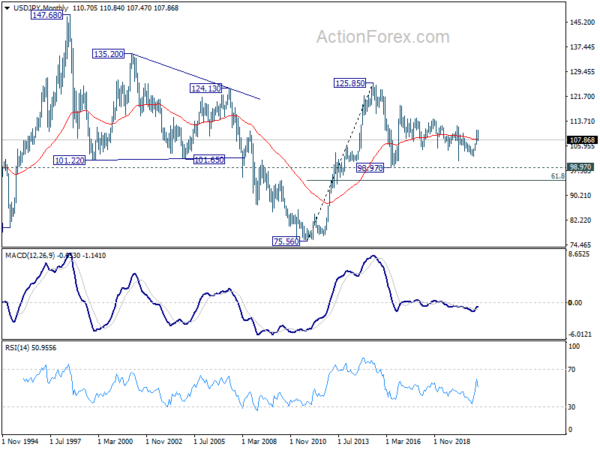

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective pattern which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.