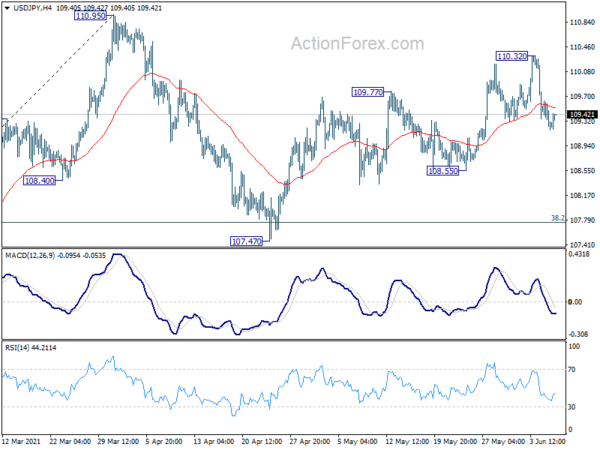

Daily Pivots: (S1) 109.09; (P) 109.36; (R1) 109.54; More…

Intraday bias in USD/JPY remains mildly on the downside at this point. Corrective rise from 107.47 should have completed at 110.32. Deeper fall would be seen to 108.55 support first. Break there should indicate that pattern from 110.95 has started the first leg already. Deeper fall would be seen to 107.47 support next. For now, risk will stay mildly on the downside as long as 110.32 holds, in case of recovery.

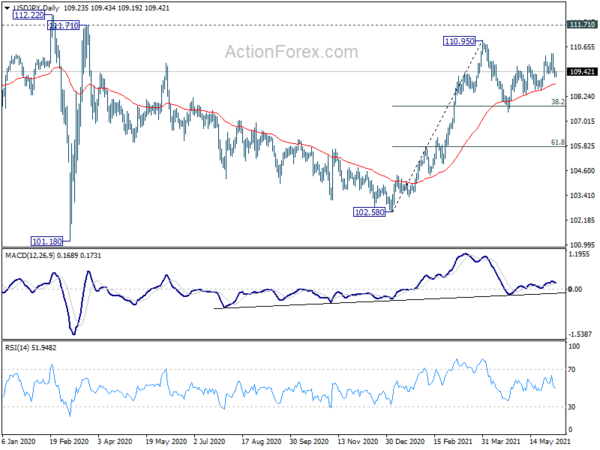

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. Though, as notable support was seen from 55 day EMA, rise from 102.58 is mildly in favor to extend higher. Decisive break of 111.71/112.22 resistance will suggest medium term bullish reversal. Rise from 101.18 could then target 118.65 resistance (Dec 2016) and above. However, sustained break of 55 day EMA would revive some medium term bearishness, and open up deep fall to 61.8% retracement of 102.58 to 110.95 at 105.77 and below.