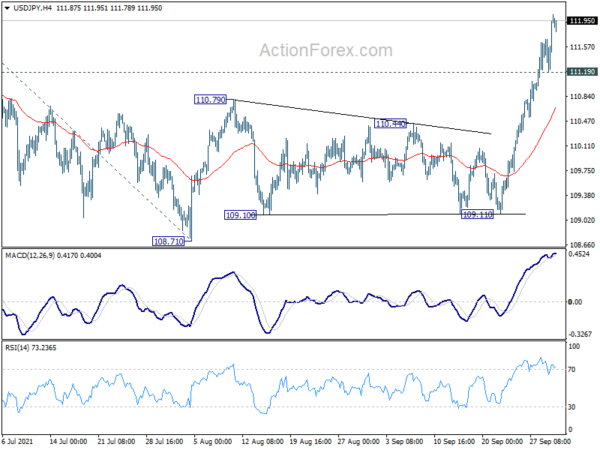

Daily Pivots: (S1) 111.44; (P) 111.75; (R1) 112.28; More…

USD/JPY’s rally is still in progress and reaches as high as 112.04 so far. The break of 111.71 medium term structural resistance is seen as a sign of long term bullish reversal. Intraday bias stays on the upside. Next target is 61.8% projection of 102.58 to 111.65 from 108.71 at 114.31. On the downside, below 111.19 minor support will turn bias neutral and bring retreat first, before staging another rally.

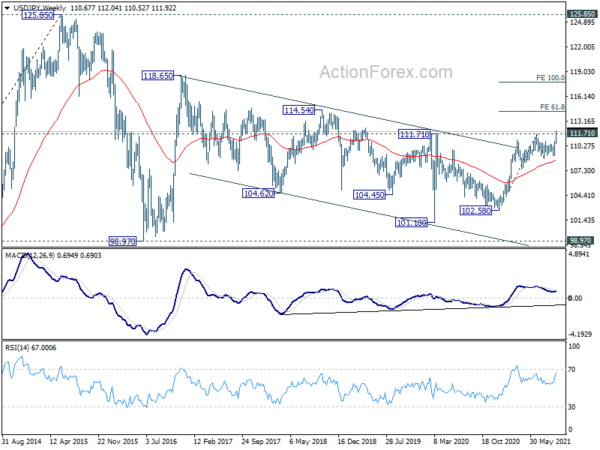

In the bigger picture, break of 111.71 resistance suggests that the whole corrective decline from 118.65 (2016 high) has completed at 101.18 (2020 low) already. Medium term bullishness is also affirmed as USD/JPY stays well above 55 week EMA (now at 108.60). Sustained trading above 111.71 will affirm this bullish case. Rise from 101.18 could then be resuming whole rally from 98.97 (2016 low) through 118.65. This will now be the preferred case as long as 108.71 support holds.