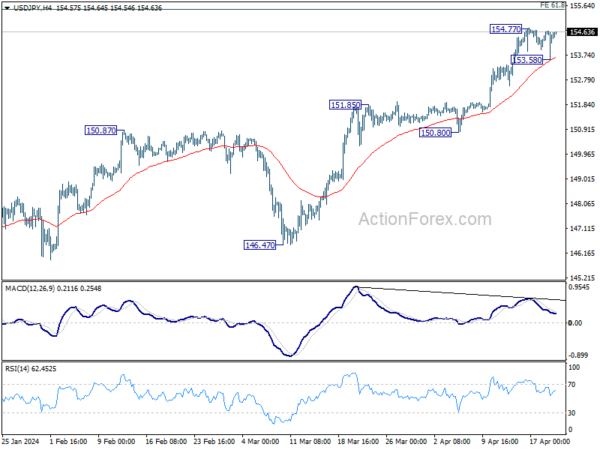

USD/JPY rose further to 154.77 last week but retreated since then. Initial bias stays neutral this week first. Break of 154.77 will resume larger up trend. But considering bearish divergence condition in 4H MACD, strong resistance should be seen from 155.20 fibonacci level to bring correction on first attempt. On the downside, break of 153.58 will turn bias to the downside, for deeper pull back to 55 D EMA (now at 150.83).

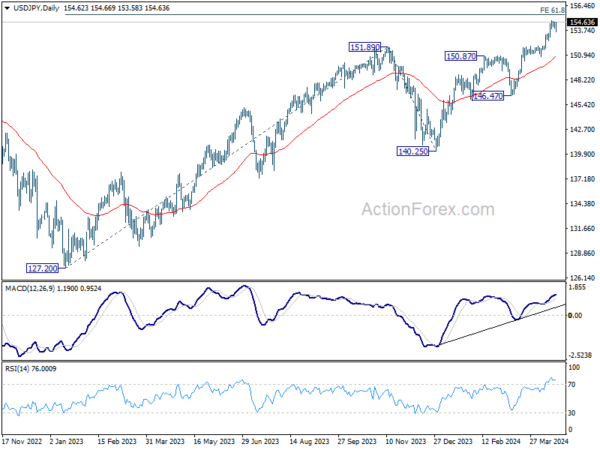

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. Outlook will remain bullish as long as 146.47 support holds, even in case of deep pullback.

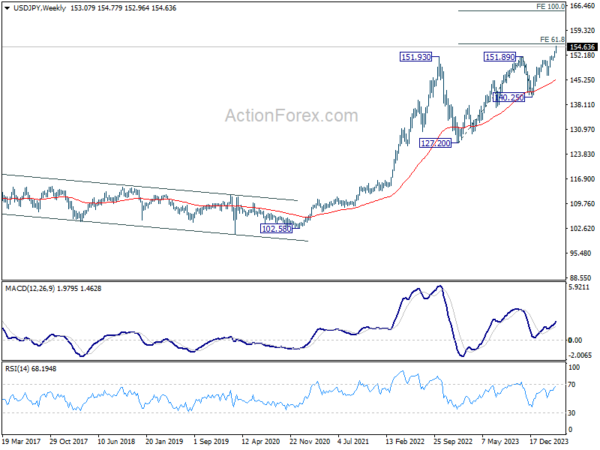

In the long term picture, as long as 127.20 support holds (2023 low), up trend from 75.56 (2011 low) is still in progress. Sustained trading above 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 102.58 at 152.87 will pave the way to 138.2% projection at 172.08. (This is a pure technical view without considering Japan’s intervention.)