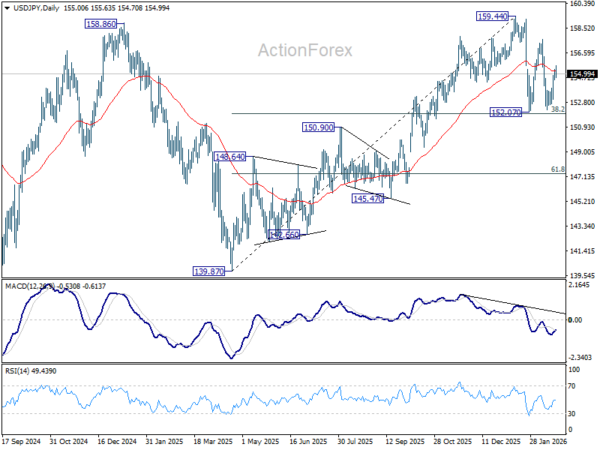

USD/JPY’s strong rebound last week suggests that fall from 157.65 has completed at 152.25. Initial bias is turned neutral this week firs. On the upside, above 155.63 will resume the rally from 152.25 and target 157.65 first. Overall, with 38.2% retracement of 139.87 to 159.44 at 151.96 intact, rise from 139.87 is expected to resume through 159.44 at a later stage.

In the bigger picture, outlook is unchanged that corrective pattern from 161.94 (2024 high) should have completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94. This will remain the favored case as long as 55 W EMA (now at 151.71) holds. However, sustained break of 55 W EMA will argue that the pattern from 161.94 is extending with another falling leg.

In the long term picture, up trend from 75.56 (2011 low) is still in progress and might be ready to resumption. Firm break of 161.94 will target 61.8% projection of 102.58 (2020 low) to 161.94 (2024 high) from 139.87 at 176.55 in the medium term. Long term outlook will stay bullish as long as 139.87 support holds, even in case of deep pullback.