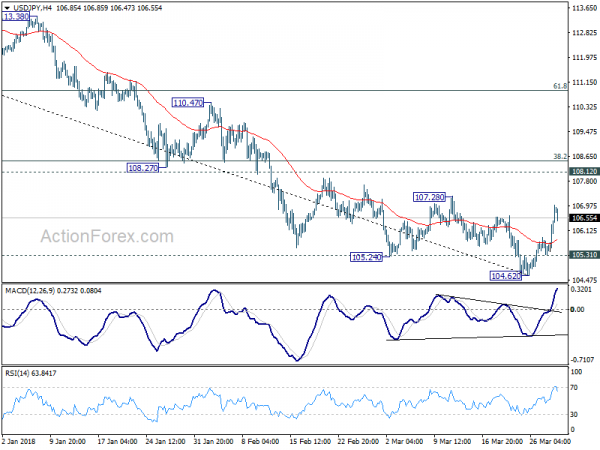

Daily Pivots: (S1) 105.12; (P) 105.51; (R1) 105.71; More…

USD/JPY’s rebound from 104.62 extended to as high as 107.00 so far. The break of 106.63 resistance indicates short term bottoming on bullish convergence condition in 4 hour MACD. Intraday bias is back on the upside for 38.2% retracement of 114.73 to 104.62 at 108.48. At this point, there is no confirmation of trend reversal yet. Hence, we’ll look at the reaction from 108.48 (which is close to 108.12 too) to assess the chance. On the downside, below 105.31 minor support will indicate that the rebound is completed and turn bias back to the downside instead.

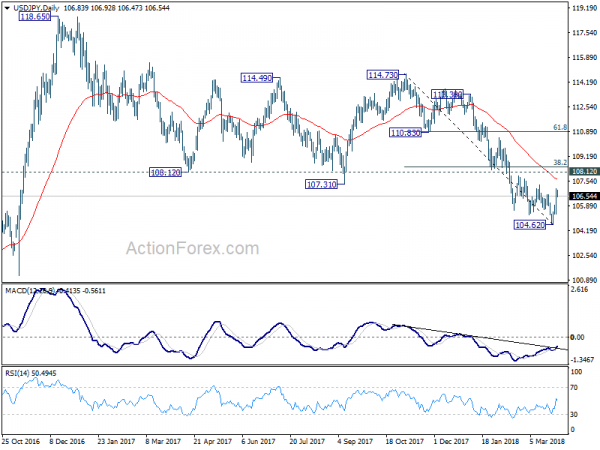

In the bigger picture, medium term down trend from 118.65 (2016 high) is still in progress and extending. Build up in downside momentum argues that it might be extending the whole corrective pattern from 125.85 (2015 high). 100% projection of 118.65 to 108.12 from 114.73 at 104.20 will be a key level to watch as firm break there could bring downside acceleration. And in that case, 98.97 key support level (2016 low) would at least be breached. This bearish case will now be favored as long as 108.12 support turned resistance holds.