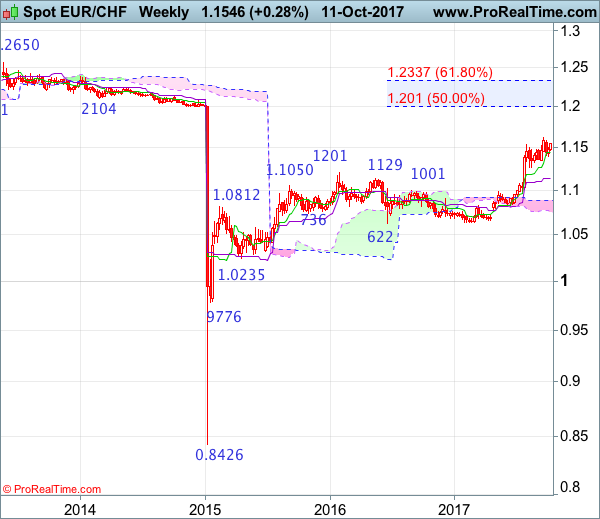

Weekly

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 24 Jul 2017

• Trend bias: Up

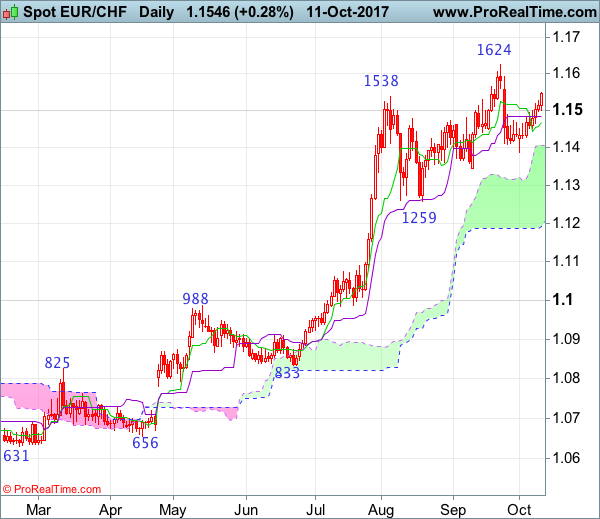

Daily

• Last Candlesticks pattern: Morning doji

• Time of formation: 25 Jul 2017

• Trend bias: Up

EUR/CHF – 1.1536

Although the single currency has rebounded after finding support at 1.1388 and marginal gain from here cannot be ruled out, if our view a temporary top formed at 1.1624 last month is correct, upside would be limited and 1.1590-95 should hold, bring another retreat later, below 1.1450 would bring test of said support at 1.1388 but break there is needed to add credence to this view, bring retracement of recent upmove to support at 1.1345, then towards 1.1300, however, another previous support at 1.1259 should hold from here.

On the upside, whilst initial marginal recovery cannot be ruled out, reckon 1.1590-95 would limit upside and bring another decline later. Above said last month’s high at 1.1624 would abort and revive bullishness, then recent upmove shall extend gain towards 1.1695-00 (61.8% projection of 1.0833-1.1538 measuring from 1.1260), however, loss of upward momentum should prevent sharp move beyond 1.1770-80 and reckon 1.1800-10 would hold from here, risk from there is seen for a retreat to take place later.

Recommendation: Hold short entered at 1.1520 for 1.1320 with stop above 1.1620.

On the weekly chart, although euro found support at 1.1388 and recovered, as long as last month’s high at 1.1624 holds, minor consolidation would be seen with mild downside bias for another retreat, below said support would bring retreat to 1.1345 support but break there is needed to signal a temporary top is possibly formed, bring retracement of recent rise to 1.1300, then towards another previous support at 1.1259 but price should stay above the Kijun-Sen (now at 1.1140) and bring rebound later.

On the upside, only break of said last month’s high at 1.1624 would signal the major rise from 0.8426 low has once again resumed and extend headway to 1.1695-00 (61.8% projection of 1.0833-1.1538 measuring from 1.1260), then towards 1.1760-70 but overbought condition should prevent sharp move beyond 1.1840-50 and reckon 1.1900-10 would hold from here, risk from there has increased for a retreat to take place later.