USD/CHF – 0.9745

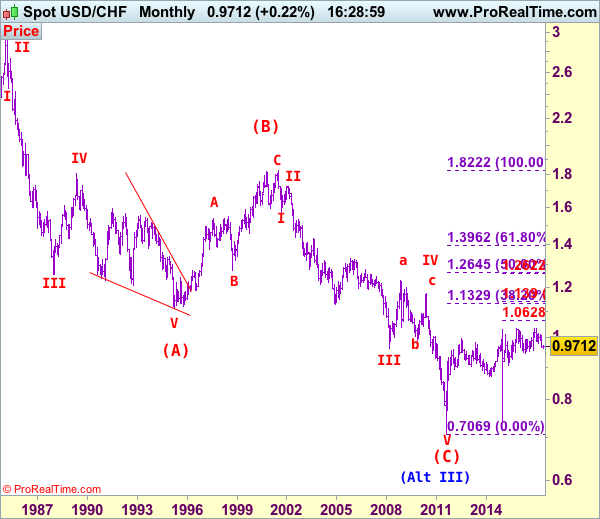

USD/CHF – Wave IV ended at 1.1730 and wave V has possibly ended at 0.7068

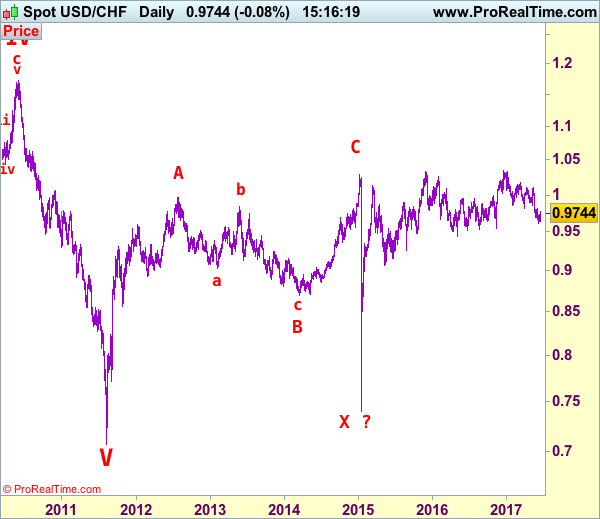

Although the greenback retreated to 0.9641, renewed buying interest emerged there and dollar has rebounded again after Fed’s rate hike, suggesting a temporary low has possibly been formed at 0.9613 earlier this month, hence consolidation above this level would be seen with mild upside bias for test of resistance at 0.9808-13, however, a daily close above this level is needed to add credence to this view, bring retracement of recent decline to 0.9855-60, then towards 0.9900. Having said that, near term overbought condition should limit upside and price should falter well below psychological resistance at 1.0000, bring another decline later.

Our preferred count on the daily chart is that early selloff to 0.9630 is an end of the larger degree wave III and major correction is unfolding from there with a leg ended at 1.2298 (Nov 2008 with (a): 1.0625, (b):1.0011 and (c):1.2298), wave b ended at 0.9910 with (a): 1.0370, (b): 1.1967, (c): 0.9910. The rise from there to 1.1730 is the wave c which also marked the end of wave IV and wave V has possibly ended at 0.7068.

On the downside, expect pullback to be limited to 0.9700 and bring another rebound. Below this week’s low at 0.9641 would risk another test of this month’s low at 0.9613 but break there is needed to revive bearishness and signal the decline from 1.0344 top has resumed for further weakness to 0.9600, then towards previous chart support at 0.9550 (Nov 2016 low), however, still reckon downside would be limited and price should stay well above another chart point at 0.9444 (2016 low)..

Recommendation: Exit short entered at 0.9800 and turn long at 0.9700 for 0.9900 with stop below 0.9600

Dollar’s long-term downtrend started from 2.9343 (Feb 1995) and it was unfolding as a (A)-(B)-(C) with (A): 1.1100, (B): 1.8310 (26 Oct 2000), then followed by another impulsive wave (C) with wave III ended at 0.9630 (Mar 2008). Under this count, correction in wave IV has possibly ended at 1.1730 and wave V already broke below support at 0.9630 and met indicated downside target at 0.7500 and 0.7400. The reversal from 0.7068 suggests the wave V has possibly ended and the breach of resistance at 0.9595 add credence to this view and indicated upside target at 1.0000 had been met, however, the sharp retreat from 1.0296 to 0.7401 suggests choppy trading would be seen but price should stay above said record low at 0.7068.