Dollar followed US stocks and yields higher overnight but it’s losing momentum in Asian session. 30 year yield was back above 3.0 handle and closed at 3.014, up 0.025. 10 year yield also reached as high as 2.390 before closing at 2.376, up 0.024. 10 year yield is now close to 2.391 near term structure resistance. Meanwhile, Dollar index staged a solid rebound and is back above 99, comparing to last week’s low at 98.54. But it will take a break of 99.46 resistance in the Dollar index to confirm near term reversal. In other markets, Gold dipped to as low as 1221 yesterday and is staying soft at around 1227. WTI crude oil’s rebound from 43.76 lost steam after failing to take out 47.01 near term resistance.

Cleveland Fed Mester: Be very vigilant against falling behind

Cleveland Fed President Loretta Mester said that Fed had already met the "maximum employment" part of the duel mandate. Meanwhile, inflation is also "nearing our 2 percent goal". To her, risks are "roughly balanced" and she urged to be "very vigilant against falling behind" and there should be no delay in further policy tightening. She warned that "if we delay too long in taking the next normalization step…we could risk a recession." Mester also sounded trying to talk down Q1 weakness as she said "although we live in a high-frequency world, we cannot overreact to transitory movements in incoming data." And she expects a "rebound in consumer spending over the rest of the year".

St. Louis Fed Bullard much more cautious

On the other hand, St. Louis Fed President James Bullard sounded much more cautious. He noted that "the first-quarter GDP growth was disappointing and it means we are starting the year in an inauspicious way…It was consumption growth that was weaker and that is a concern because consumption has been a strong point." Also, "on inflation the numbers were disappointing. We have been telling a story that we are trending back towards 2 percent and we went the other way." Regarding interest rate he said that "the policy rate is approximately at an appropriate setting today."

Room for hawkish twist in BoE

Sterling is mildly firmer this week as markets await BoE Super Thursday. While no change in policies is generally expected, a focus will be on the vote split. It should be reminded again then Sterling launched this round of rally against Dollar and Euro after Kristin Forbes surprised the markets by voting for a rate hike back in March. Weak Q1 growth might keep other MPC hawks from joining Forbes. But the hawk camp could be getting more impatient with headline CPI back in target range at 2.3% yoy in March.

While there are still many uncertainties around Brexit, it should also be noted that interest rate is held at an ultra low level at 0.25%. BoE Governor Mark Carney has already been clear that some policy tightening is considered in the central bank’s economic projections. But now markets are pricing in less than 60% chance of any move by BoE before end of 2018. There is much room for a hawkish twist in BoE’s announcements this weak that could lift Sterling further.

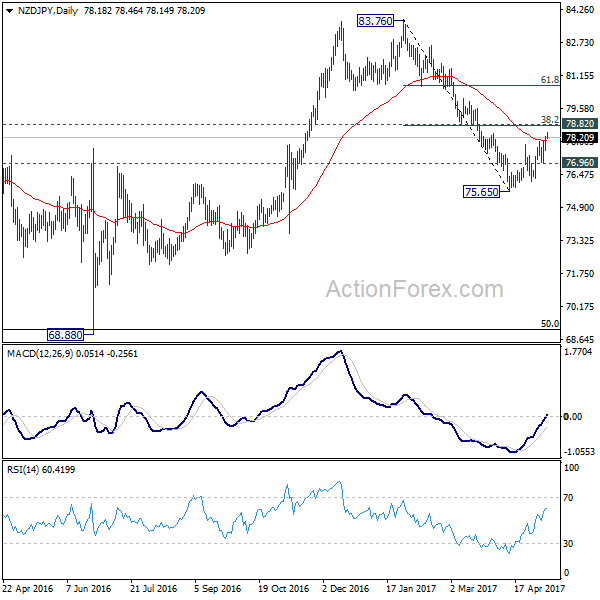

NZD/JPY to face 78.74/82 resistance

New Zealand Dollar also firmed up again this week as markets await a more upbeat RBNZ statement. NZD/JPY and AUD/NZD are indeed the two top movers this month as Kiwi decoupled from Aussie. Taking a look at NZD/JPY, the rebound from 75.65 is extended to as high as 78.46 so far. But it seems to be struggling to find follow through buying above 55 day EMA. Price actions from 75.65 is also corrective looking. Hence, while further rise could be seen in near term, we’d be cautious on strong resistance from 78.82 cluster (38.2% retracement of 83.76 to 75.65 at 78.74) to limit upside. Break of 76.96 minor support will resume the fall fro 83.76 through 75.65 low.

On the data front

Japan labor cash earnings dropped -0.4% yoy in March. Australia retail sales rose 0.1% mom in March. UK BRC retail sales monitor rose 5.6% yoy in April. Swiss will release unemployment rate. Germany will release industrial production and trade balance. Canada will release building permits today.

EUR/CHF Daily Outlook

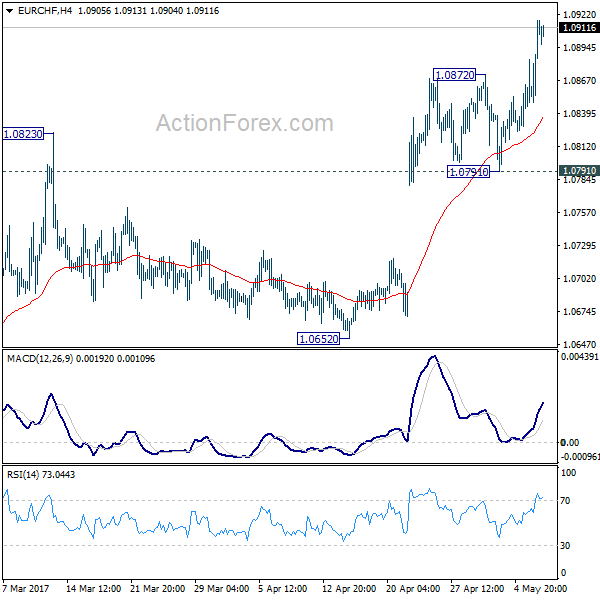

Daily Pivots: (S1) 1.0867; (P) 1.0892; (R1) 1.0936; More…

EUR/CHF’s rally extends to as high as 1.0917 so far. The firm break of 1.0897 resistance as well as the medium term falling trend line affirmed our view of trend reversal. That is, whole correction from 1.1198 is completed. This is also supported by upside acceleration as seen in daily MACD. Intraday bias bias remains on the upside for 1.0999 resistance next. Break there will pave the way for a retest on 1.1198 high. On the downside, below 1.0872 minor support will turn bias neutral and bring consolidation. But retreat should be contained by 1.0791 support to bring another rally.

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Current strong rebound is raising the chance that it’s completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.0999 resistance will target a test on 1.1198 high. For now, this will be the preferred case as long as 1.0791 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Apr | 5.60% | 0.50% | -1.00% | |

| 0:00 | JPY | Labor Cash Earnings Y/Y Mar | -0.40% | 0.40% | 0.40% | |

| 1:30 | AUD | Retail Sales M/M Mar | 0.10% | 0.30% | -0.10% | |

| 5:45 | CHF | Unemployment Rate Apr | 3.30% | 3.40% | ||

| 6:00 | EUR | German Industrial Production M/M Mar | -0.70% | 2.20% | ||

| 6:00 | EUR | German Trade Balance (EUR) Mar | 21.7B | 21.0B | ||

| 12:30 | CAD | Building Permits M/M Mar | -2.50% | |||

| 14:00 | USD | Wholesale Inventories Mar F | -0.10% | -0.10% |