The financial markets are holding their breaths as US House delayed the vote of President Donald Trump’s health care plan. DJIA recovered to 20757.89 overnight but closed down -0.02% at 20656.68. S&P 500 also recovered to 2358.92 but closed down -0.11% at 234596. 10 year yield recovered by closing up 0.022 at 2.418 but stayed below 55 day EMA at 2.434. Gold lost momentum after failing to stay above 1250 an is trading in tight range around 1245. WTI crude oil is also bounded in right range between 47/48.5. Dollar index recovers after dipping to 99.54 but is yet to find follow through buying to get pass 100 at the time of writing.

Vote on healthcare act postponed to Friday

A vote on Trump’s American Health Care Act was originally scheduled in House yesterday. House Republicans had a closed-door meeting but it’s reported that after frantic negotiations, there are still some conservatives who are not convinced. For the conservatives, the bill was still too costly and did not do enough to roll back so called Obamacare. Meanwhile, some moderates worried that the loss of benefits to some would be too much for their constituents to bear.

The vote is now scheduled for Friday after Trump offered ultimatum to House Republicans. Trumps’ budget director Mick Mulvaney warned that if the vote fails, the administration will just move on to other priorities like tax reform. And in that case, Obamacare will stay. It should be noted again that the health care bill is seen as a litmus test for Trump’s ability to push through his reforms. A failure will heighten the concern that he would not be able to fulfill his election promises on tax cut and infrastructure spending. Stocks and yields would likely extend this week’s fall then.

Fed Williams: Three or more hike this year

San Francisco Fed President John Williams said that "three or maybe even more increases this year, makes sense to me, but it would depend on the data." He sounded upbeat regarding the economy and said that momentum "has been very positive". And "risks are pretty balanced overall, which is a good place to be." And, "maybe news of significant fiscal stimulus" would give the Fed the reasons for a faster rate path.

Dallas Fed President Robert Kaplan, on the other hand, wanted a "gradual and patient" approach in rate hike. He also noted that trimming the balance sheet is an appropriate further step for the Fed. Minneapolis Fed President Neel Kashkari urged Fed to reduce the balance sheet as soon as possible. Fed Chair Janet Yellen also spoke yesterday but she didn’t touch on monetary policy.

Elsewhere…

New Zealand trade deficit narrowed to NZD -18m in February but missed expectation of NZD 160m surplus. Japan PMI manufacturing dropped to 52.6 in February. Eurozone PMIs will be the main feature in European session. UK will release BBA mortgage approvals. In US session, focus will be on US durable goods orders and Canada CPI.

USD/JPY Daily Outlook

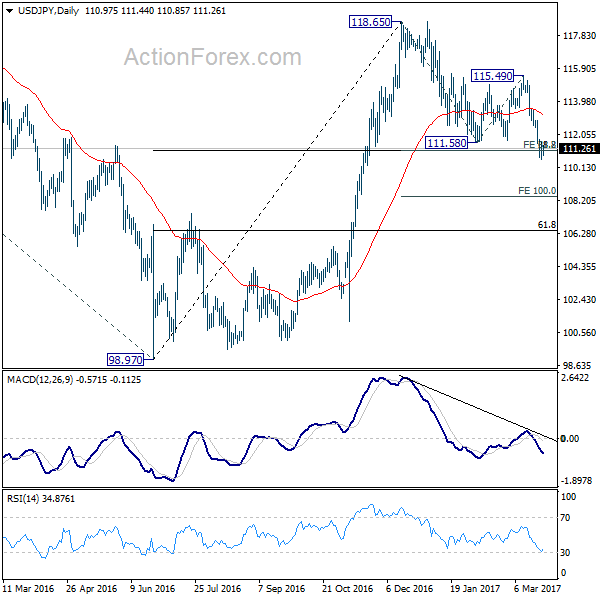

Daily Pivots: (S1) 110.50; (P) 111.03; (R1) 111.45; More…

A temporary low is in place at USD/JPY with 4 hour MACD staying above signal line. Intraday bias is turned neutral first. At this point, we’re still favoring the case for strong support around 111.12/13 to bring rebound. This level represents 61.8% projection of 118.65 to 111.58 from 115.49 at 111.12 and 38.2% retracement of 98.97 to 118.65 at 111.13. Break of 112.86 resistance will indicates completion of the correction from 118.65. In such case, intraday bias will be turned back to the upside for 115.49 resistance and above. However, sustained trading below 111.12/13 will pave the way to 100% projection at 108.42 next.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Nonetheless, sustained trading below 55 week EMA (now at 111.12) will extend the consolidation from 125.85 with another fall through 98.97 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Feb | -18M | 160M | -285M | -257M |

| 21:45 | NZD | Exports (New Zealand dollars) Feb | 4.01b | 4.20b | 3.91b | |

| 0:30 | JPY | PMI Manufacturing Mar P | 52.6 | 53.5 | 53.3 | |

| 8:00 | EUR | France Manufacturing PMI Mar P | 52.4 | 52.2 | ||

| 8:00 | EUR | France Services PMI Mar P | 56.1 | 56.4 | ||

| 8:30 | EUR | Germany Manufacturing PMI Mar P | 56.5 | 56.8 | ||

| 8:30 | EUR | Germany Services PMI Mar P | 54.5 | 54.4 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Mar P | 55.3 | 55.4 | ||

| 9:00 | EUR | Eurozone Services PMI Mar P | 55.3 | 55.5 | ||

| 9:30 | GBP | BBA Mortgage Approvals Feb | 44.9K | 44.7K | ||

| 12:30 | CAD | CPI M/M Feb | 0.20% | 0.90% | ||

| 12:30 | CAD | CPI Y/Y Feb | 2.10% | 2.10% | ||

| 12:30 | CAD | CPI Core- Common Y/YFeb | 1.30% | |||

| 12:30 | CAD | CPI Core- Median Y/YFeb | 1.90% | |||

| 12:30 | CAD | CPI Core- Trim Y/YFeb | 1.70% | |||

| 12:30 | USD | Durable Goods Orders Feb P | 1.20% | 2.00% | ||

| 12:30 | USD | Durables Ex Transportation Feb P | 0.70% | 0.00% |