The financial markets are clearly in risk averse mode on escalating geopolitical tensions. Gold jumps to as high as 1281.8 so far, comparing to last week’s close at 1257.3, and is heading towards 1300 handle. WTI crude oil also extends recent rally to as high as 53.6, still on course to 55.24 key resistance. Safe haven flows into US treasury also pushed yield lower with 10-year yield losing -0.063 to close at 2.298. And 10-year yield is now having last week’s spike low at 2.271 in sight. Reactions in stock were relatively muted as DJIA dipped to 20512.56 but closed at 20651, down just -0.03%. Though, notable weakness is seen in Nikkei as it’s trading down -1.2% at the time of writing.

In the currency markets, the Japanese Yen jumps broadly on risk aversion. And technically, USD/JPY, EUR/JPY and GBP/JPY are extending recent near term fall. Aussie and Kiwi are the weakest ones but Canadian Dollar is supported by oil price. Falling US treasury yield drags down Dollar, which is trading as the second weakest for the time being.

North Korea tension escalates

Geopolitical tension escalated again when US President Donald Trump tweeted saying that North Korea is looking for trouble. And, "if China decides to help, that would be great. If not, we will solve the problem without them! U.S.A." And then Trump sent an "Armada. Very powerful" to Korean peninsula in a show of force. North Korean government responded by warning to take "the toughest counteraction against the provocateurs". And, North Korea will "not miss a chance to sweep the imperialist group with a nuclear fire of justice." The official Rodong Sinmun newspaper also warned that "Our revolutionary strong army is keenly watching every move by enemy elements with our nuclear sight focused on the U.S. invasionary bases not only in South Korea and the Pacific operation theater but also in the U.S. mainland."

How about tensions with Russia?

Meanwhile, US Defense Secretary Jim Mattis said that the US and Russia tensions will not "spiral out of control" as the military operation in Syria was a one-off. Mattis put the responsibility on Russia and said that "I’m confident the Russians will act in their own best interest and there is nothing in their best interest to say they want this situation to go out of control." Separately, US Secretary of State Rex Tillerson arrived in Moscow yesterday, less than a week after US bombed Syria in response to the government’s use of chemical weapons on civilians. Tillerson warned that Russia can choose to a part to "relieve suffering of the Syrian people", or "maintain" its alliance with Syria and Iran. Russian President Vladimir Putin said he knew about the panned "provocations" to blame Syrian government and emphasized that UN should first investigate the attack.

San Francisco Fed Williams Blasts tariffs

San Francisco Fed President John Williams said that "three to four rate hikes seem appropriate this year". And Fed should "also begin to normalize our balance sheet towards the end of this year". Meanwhile, William also criticized the idea of imposing tariffs on countries that run a trade surplus with US. He said that higher tariffs would be "bad for growth, bad for jobs and bad for inflation." And he hoped that "there may be some separating of campaign rhetoric from what actually happens". Separately, Minneapolis Fed President Neel Kashkari said Fed "can do a little bit better" on inflation and employment.

BoJ Kuroda sounds more conscious on stimulus exit

BoJ Governor Haruhiko Kuroda told the parliament that the central bank’s policy "doesn’t directly target exchange rate". Nonetheless, "it’s true that if the yen weakens, it may quicken achievement of our price target." Meanwhile, Kuroda also noted there are "a lot of measures" at the central bank’s disposal for stimulus exit. And he pledged that BoJ can "take the most appropriate policy steps while maintaining market stability, which would include reducing the size of our balance sheet." Some analysts noted that Kuroda sounds more conscious about stimulus exit. And that could either be because he’s more confidence in inflation, or he just wanted to avoid criticism of not having a plan.

On the data front…

Japan machine orders rose 1.5% mom in February. Domestic CGPI rose 1.4% yoy in March. China CPI rose 0.9% yoy in March, PPI rose 7.6% yoy. Australia Westpac consumer confidence dropped -0.7% in April. UK job data will be the main focus in European session. BoC will also announce rate decision later in the day and is widely expected to keep interest rate unchanged at 0.50%.

USD/JPY Daily Outlook

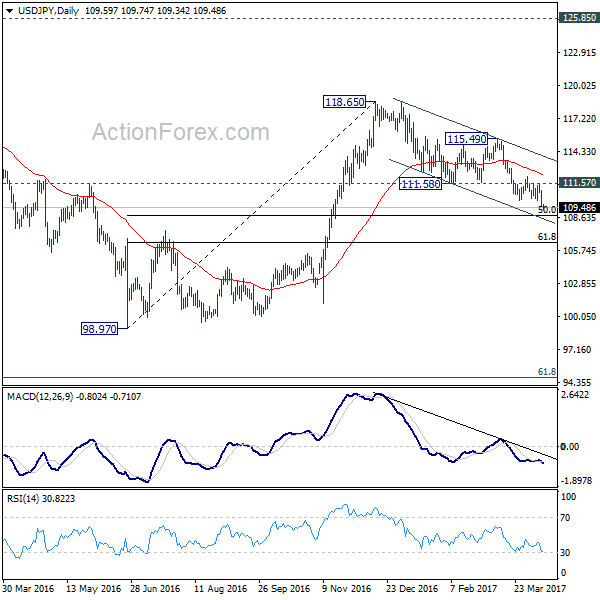

Daily Pivots: (S1) 109.15; (P) 110.04; (R1) 110.49; More….

USD/JPY’s strong break of 110.10 support confirms resumption of near term decline from 118.65. Intraday bias is back on the downside for 50% retracement of 98.97 to 118.65 at 108.81. At this point, there is no clear indication of reversal yet and it’s staying comfortably inside a falling channel. Break of 108.81 will target 61.8% retracement at 106.48 and possibly below. Meanwhile, on the upside, break of 111.57 resistance is needed to be the first sign of reversal. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. Sustained trading below 55 week EMA (now at 111.15) will indicate that the second leg from 98.97 has completed at 118.65. And in that case, USD/JPY would start the third leg down through 98.97 low to 61.8% retracement of 75.56 to 125.85 at 94.77. On the upside, break of 115.49 resistance should resume the rise from 98.97 for a test on 125.85 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Feb | 1.50% | 3.70% | -3.20% | |

| 23:50 | JPY | Domestic CGPI Y/Y Mar | 1.40% | 1.40% | 1.00% | 1.10% |

| 00:30 | AUD | Westpac Consumer Confidence Apr | -0.70% | 0.10% | ||

| 01:30 | CNY | CPI Y/Y Mar | 0.90% | 1.00% | 0.80% | |

| 01:30 | CNY | PPI Y/Y Mar | 7.60% | 7.50% | 7.80% | |

| 08:30 | GBP | Jobless Claims Change Mar | -10.2K | -11.3k | ||

| 08:30 | GBP | Claimant Count Rate Mar | 2.10% | |||

| 08:30 | GBP | ILO Unemployment Rate (3M) Feb | 4.70% | 4.70% | ||

| 08:30 | GBP | Average Weekly Earnings 3M/Y Feb | 2.20% | 2.20% | ||

| 12:30 | USD | Import Price Index M/M Mar | -0.30% | 0.20% | ||

| 14:00 | CAD | BoC Rate Decision | 0.50% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | 1.M | |||

| 18:00 | USD | Monthly Budget Statement Mar | -150.0B | -192.0B |