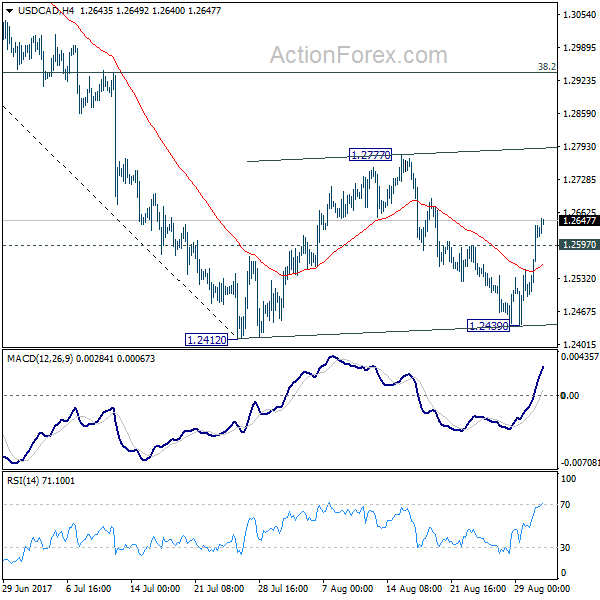

Daily Pivots: (S1) 1.2535; (P) 1.2585; (R1) 1.2671; More….

USD/CAD’s strong rebound and break of 1.2597 minor resistance suggests that consolidation pattern from 1.2412 has started the third leg. Intraday bias is turned back to the upside for 1.2777 resistance and above. But upside should be limited by 38.2% retracement of 1.3793 to 1.2412 at 1.2940 to bring fall resumption eventually. On the downside, break of 1.2412 will extend larger fall from 1.3793 and target next long term fibonacci level at 1.2048.

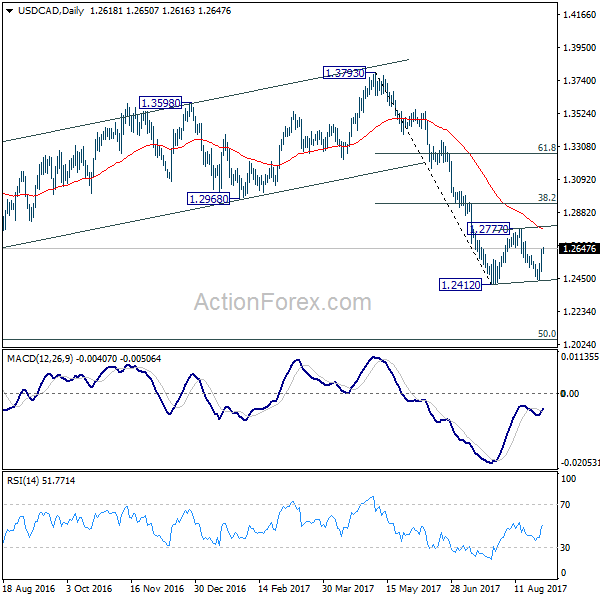

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Such corrective fall is still expected to extend to 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. Nonetheless, on the upside, sustained break of 1.2968, 38.2% retracement of 1.3793 to 1.2412 at 1.2940 will be the first sign of completion of the correction and will turn focus back to 1.3793 key resistance.