Key Highlights

- The New Zealand Dollar traded towards 0.6880 and later corrected lower against the US Dollar.

- Earlier, there was a break below a key bullish trend line with support at 0.6810 on the 4-hours chart of NZD/USD.

- The US GDP in Q3 2018 (Prelim) grew 3.5%, similar to the market forecast.

- Today in the US, the FOMC Meeting Minutes will be released, which could impact the market sentiment.

NZDUSD Technical Analysis

The New Zealand Dollar remained in a decent uptrend and traded above the 0.6750 and 0.6800 resistances. However, the NZD/USD pair faced sellers near 0.6880 and later started a downside correction.

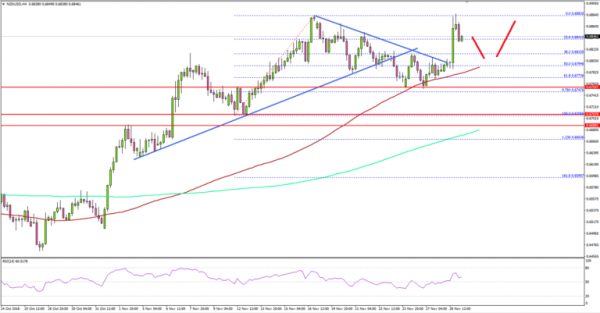

Looking at the 4-hours chart, the pair formed a high at 0.6883 and later declined below the 0.6850 support level. During the slide, there was a break below the 50% Fib retracement level of the last wave from the 0.6705 low 0.6883 high.

Moreover, there was a break below a key bullish trend line with support at 0.6810 on the same chart. The pair declined below 0.6800 and tested the 0.6750 support along with the 100 simple moving average (red, 4-hours).

There was no proper test of the 76.4% Fib retracement level of the last wave from the 0.6705 low 0.6883 high. The pair bounced back sharply and revisited the 0.6880 resistance.

On the downside, the key supports are at 0.6840 and 0.6810, which were resistances earlier. As long as the pair is above 0.6810, it could bounce back in the near term. On the upside, an initial resistance is at 0.6880, above which the pair must surpass 0.6900 to revisit the 0.6920 and 0.6950 levels.

Fundamentally, the US Gross Domestic Product Annualized reading for Q3 2018 (Prelim) was released by the US Bureau of Economic Analysis. The market was looking for a growth of around 3.5% in Q3 2018.

The result was in line with the forecast as the USD GDP grew 3.5% in Q3 2018, according to the “second” estimate. The report added that:

Real gross domestic income (GDI) increased 4.0 percent in the third quarter, compared with an increase of 0.9 percent (revised) in the second quarter. The average of real GDP, increased 3.8 percent in the third quarter, compared with an increase of 2.5 percent (revised) in the second quarter.

Overall, it seems like pairs like EUR/USD, GBP/USD, AUD/USD and NZD/USD may perhaps struggle to gain traction in the short term.

Economic Releases to Watch Today

- German Consumer Price Index for Nov 2018 (YoY) (Prelim) – Forecast +2.4%, versus +2.5% previous.

- Euro Zone Economic Sentiment Indicator Nov 2018 – Forecast 109.0, versus 109.8 previous.

- FOMC Meeting Minutes.

- US Initial Jobless Claims – Forecast 220K, versus 224K previous.

- US Personal Income for Oct 2018 (MoM) – Forecast +0.4%, versus +0.2% previous.

- US Pending Home Sales for Oct 2018 (MoM) – Forecast +0.5%, versus +0.5% previous