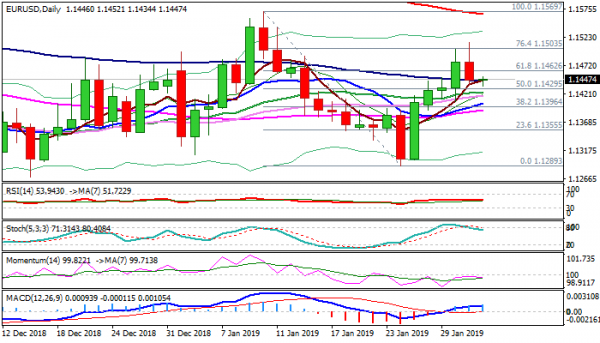

The Euro is consolidating above broken former strong resistance, now support at 1.1429 (daily Kijun-sen / broken Fibo 50% of 1.1569/1.1289 / Fibo 38.2% of 1.1289/1.1514) in early Friday’s trading after strong five-day rally was strongly rejected at 1.15 zone and Thursday’s action ended in bearish daily candle with long upper shadow, signaling that bulls might be running out of steam.

Slow stochastic emerged from overbought territory and momentum remains weak, adding to negative signals for further easing.

Daily cloud is thinning and twists next week and could also attract fresh near-term bears.

Breach of 1.1429 pivot would risk extension towards key supports at 1.1384 (cloud twist) and 1.1375 (Fibo 61.8% of 1.1289/1.1514), loss of which would confirm reversal.

Ability to hold above 1.1429 would keep in play hopes for fresh upside, with eventual weekly close above 20WMA (1.1436) which capped weekly actions since mid-Sep, needed to reinforce positive signal.

Also, US jobs data, due later today, are expected to generate fresh signals.

Non-farm payrolls are forecasted to dip significantly in Jan (165K f/c vs 312K in Dec), impacted by partial US government shutdown in Jan.

Disappointing US labor data would increase pressure on the greenback, which was already hit by dovish stance from Fed and could boost the single currency to emerge from dangerous territory.

Res: 1.1436, 1.1461, 1.1514, 1.1540

Sup: 1.1429, 1.1400, 1.1384, 1.1375